🚗 ICBC Basic Autoplan: Core Coverages & Limits 🇨🇦

If you drive in British Columbia, you know ICBC’s Basic Autoplan is mandatory. But do you know what it actually covers—and where it stops? Understanding the essentials can help you avoid costly surprises after an accident.

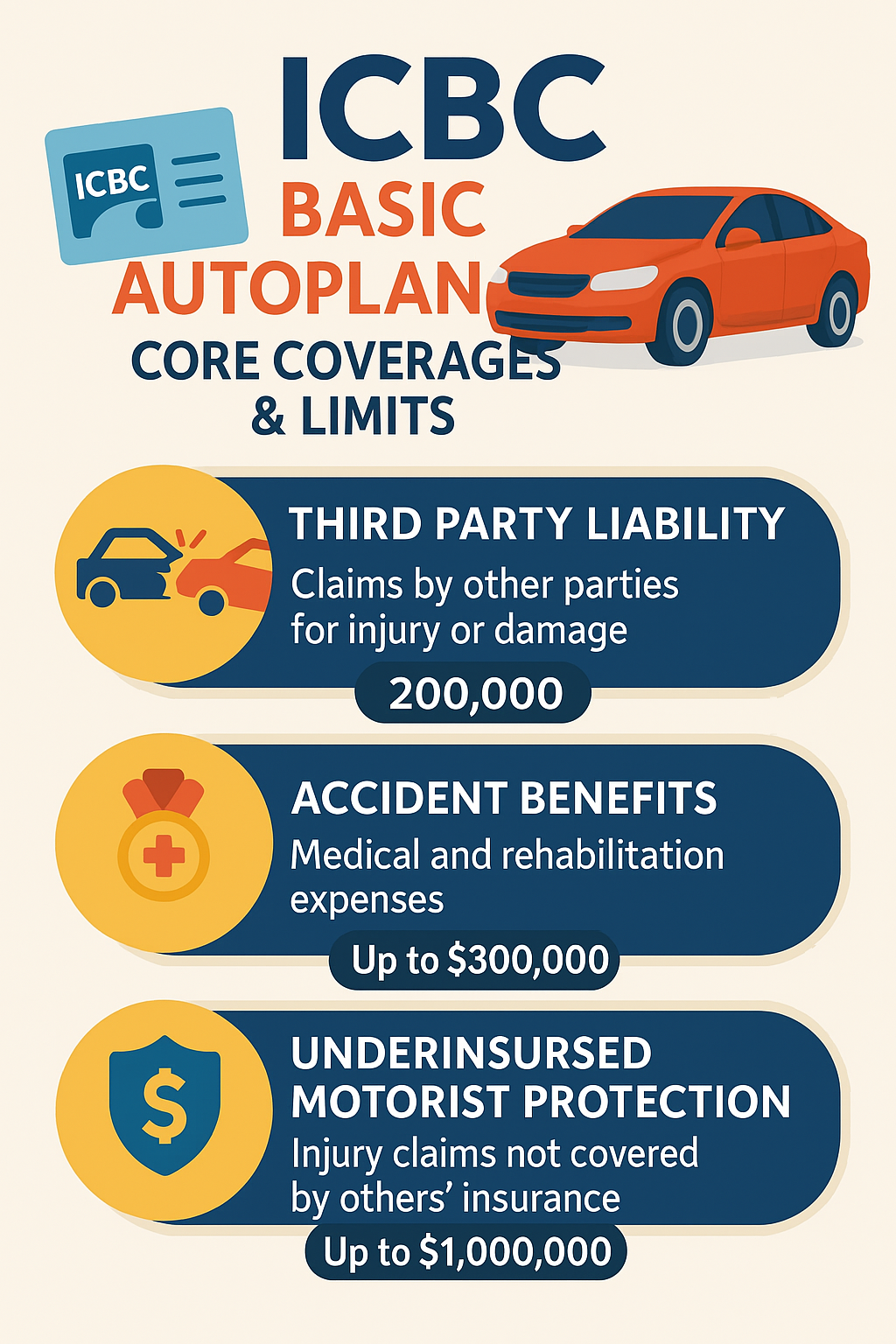

⚡ What Basic Autoplan Covers

- Third-Party Liability 🛡️

Protects you if you’re at fault in a crash that causes injury or property damage to others. The minimum limit is $200,000, though higher coverage is strongly recommended. - Accident Benefits 🚑

Covers medical and rehabilitation expenses for you and your passengers, no matter who is at fault. - Underinsured Motorist Protection 💼

Provides up to $1 million if you’re injured by a driver who doesn’t have enough insurance. - Hit-and-Run Protection 🚦

Coverage for injuries or property damage caused by unidentified drivers. - Inverse Liability 🚙

Protects you when driving in jurisdictions with different liability rules.

📌 Why It Matters

Basic Autoplan ensures every driver in BC has a safety net, but its minimum limits may fall short in serious accidents. For instance, if damages exceed $200,000, you could be personally responsible for the difference.

✅ The Bottom Line

Basic Autoplan gives you the foundation you need—but most drivers benefit from optional coverages such as higher liability limits, collision, and comprehensive protection. A quick conversation with a broker can help you tailor your policy to your situation.

👉 Have you reviewed your ICBC coverage lately?

#ICBC #Autoplan #InsuranceCanada #BritishColumbia #AutoInsurance #RiskManagement #BCDrivers #CommercialInsurance