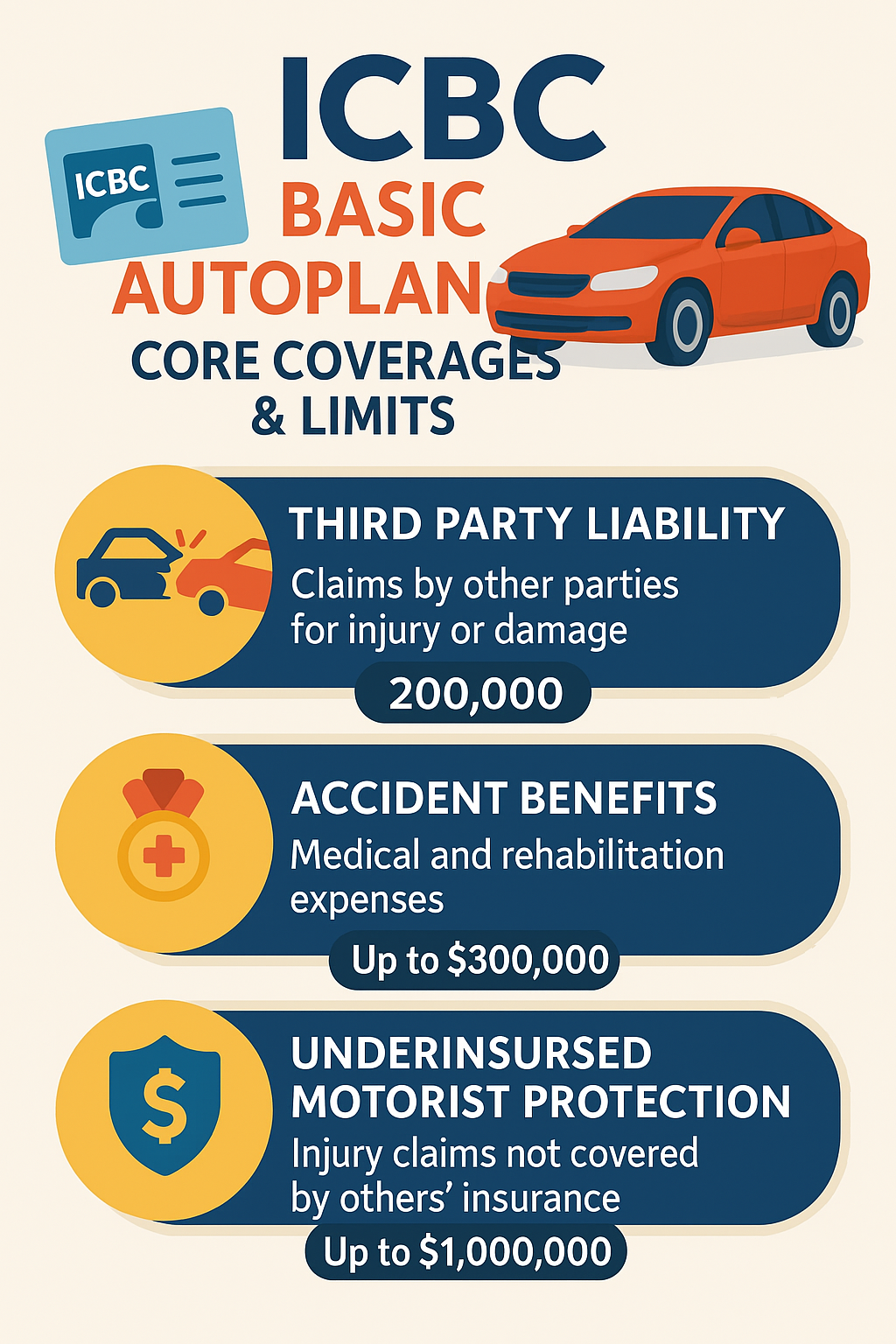

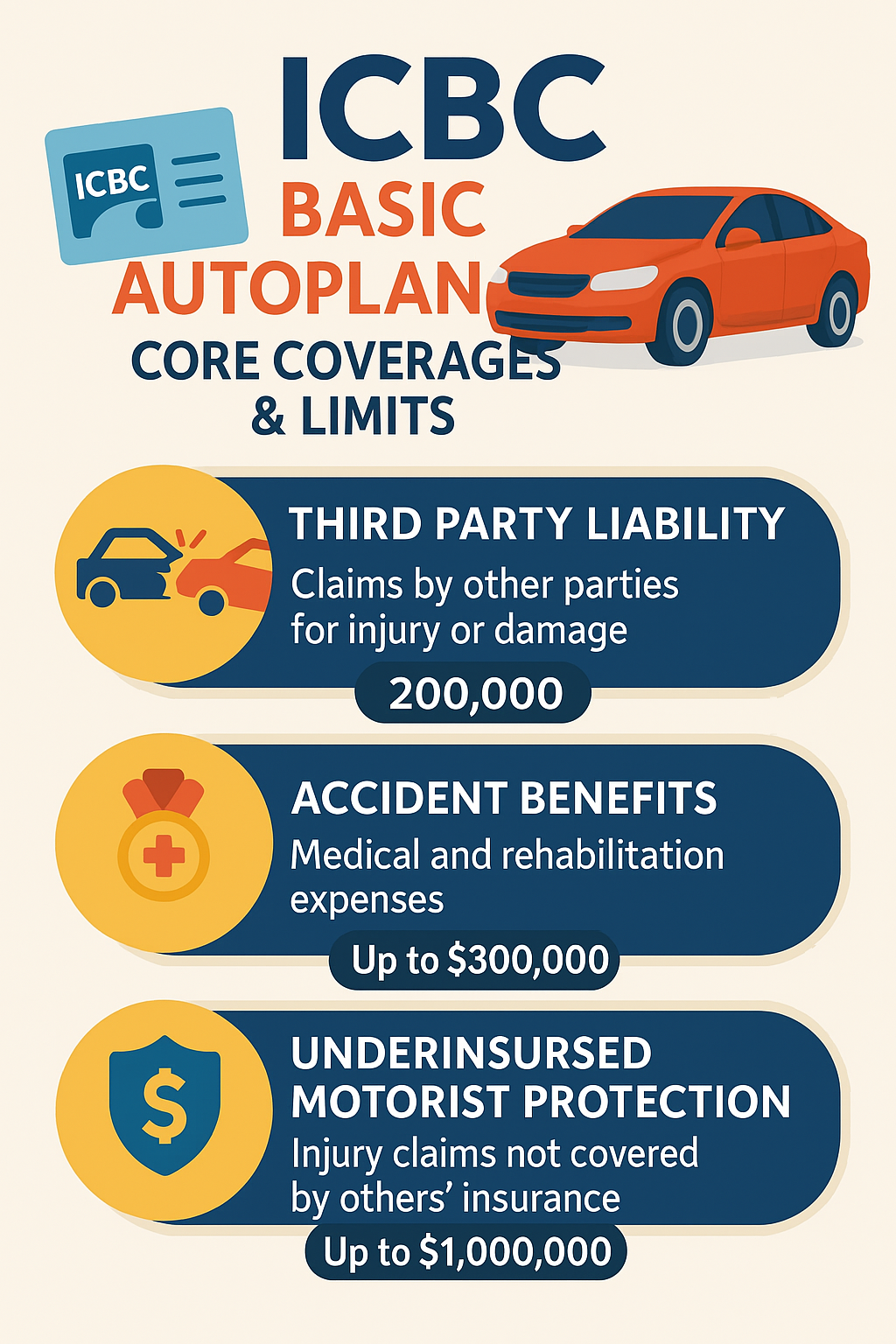

🚗 ICBC Basic Autoplan: Core Coverages & Limits 🇨🇦

If you drive in British Columbia, you know ICBC’s Basic Autoplan is mandatory. But do you know what it actually covers—and where it stops? Understanding

Get the most competitive quote from us. We have helped save 1000s of dollars for our clients.

S & S Insurance For Cannabis

Jump To Section:

Comprehensive Solutions To Protect You

Operating a cannabis business in British Columbia comes with unique exposures that standard commercial policies often overlook. Fire, theft, vandalism, equipment breakdown, and product spoilage can quickly derail operations and strain your cash flow. As a cannabis-focused insurance broker, we analyze your facility layout, security measures, inventory values, and key revenue drivers to identify where you are most vulnerable. Then we negotiate with specialized insurers to protect your buildings, stock, equipment, cash, and revenue under one coordinated program. Coverage can extend from seedlings and mature plants to finished product in storage or transit, as well as your office contents, signage, and tenant improvements. By proactively managing these everyday risks, insurance helps stabilize your operating costs, supports compliance with lenders and landlords, and gives you confidence to focus on growing your business.

Cannabis operations need more than basic property insurance; they require a carefully assembled package that matches the entire lifecycle of the product. As your broker, we coordinate commercial property, crop, and stock coverage with general liability, product liability, and tenants legal liability to protect you if something goes wrong on-site or after products leave your premises. For owners with significant equipment and technology investments, we can add equipment breakdown and cyber coverage for point-of-sale, e‑commerce, and patient data systems. Business interruption insurance helps replace lost income and extra expenses if a covered loss forces you to slow down or temporarily close. Whether you run an indoor grow, licensed processing lab, cannabis retail storefront, or vertically integrated operation, we help build a comprehensive, scalable program that grows alongside your business.

Cannabis claims in British Columbia often stem from fire, water damage, theft, or equipment breakdown affecting grow rooms, processing areas, or retail spaces. In a typical fire claim, property insurance can respond to repair the building, replace damaged equipment, and cover lost stock, while business interruption coverage helps replace lost income during downtime. If a refrigeration or HVAC failure causes product spoilage, stock and equipment breakdown coverage may pay to replace affected inventory and repair the system. For dispensaries, robbery or burglary claims can trigger coverage for stolen stock, damaged fixtures, and in some cases, money and securities, subject to policy limits. Product liability coverage can respond if a customer alleges bodily injury or property damage from your product. As your broker, we clarify claim pathways, help document losses, and advocate for fair settlements.

Coverages Available For You

Business insurance safeguards against unexpected incidents like property damage or legal claims. Protect your company’s future with tailored insurance solutions.

Business interruption insurance replaces lost income and covers expenses when your BC business is forced to close due to a covered event like fire or natural disaster.

Business liability insurance protects BC companies from financial losses due to lawsuits, covering legal costs and damages for third-party injuries or property damage.

Comprehensive insurance protecting goods in transit and storage, ensuring your cargo and stock are covered against loss, damage, or theft worldwide.

Commercial auto insurance covers vehicles used for business purposes, protecting against liability, damages, and accidents involving your company’s cars, trucks, or vans.

Protect your business in British Columbia with tailored commercial insurance that covers liability, property damage, and more, ensuring peace of mind for entrepreneurs. Commercial insurance implies a broader umbrella covering larger enterprises, complex industrial operations, or specialized fleets. It frequently refers to “Commercial Package Policies” (CPP) that allow companies to bundle complex coverages (like liability, property, and fleet) à la carte with higher limits.

Protect your business assets with comprehensive coverage for property damage and loss.

Cyber insurance in British Columbia safeguards businesses against financial losses from cyber incidents, ensuring protection from data breaches, extortion, and operational disruptions.

Protect your leadership with Directors & Officers insurance in BC. Safeguard personal assets and decision-making from legal challenges in today’s complex business environment.

Protects shipowners from financial losses due to vessel detention following drug seizures by authorities.

Employment Practices Liability Insurance (EPLI) protects businesses in British Columbia against employee claims related to discrimination, wrongful termination, and harassment.

Protect your business assets with comprehensive equipment breakdown insurance, covering mechanical and electrical malfunctions.

Commonly Asked Questions

Discover our streamlined insurance process designed to be quick and straightforward. From initial quote to policy purchase, we guide you through every step to ensure your complete satisfaction.

Begin with your information to get a detailed insurance quote.

We’ll gather your personal or business information through our secure form to create an insurance quote just for you.

Review coverage choices from different providers and choose the best one.

We’ll guide you through comparing insurance options, helping you select the plan that best matches your coverage needs and budget.

We’ll help you secure your policy quickly, providing immediate access to your documents and full dedicated support.

Our team of experts specializes in home, auto, business, life, travel insurance, and more, providing you with tailored guidance to ensure you receive the best possible coverage.

S&S stands apart with a blend of local expertise and personal commitment, creating insurance solutions that resonate with your needs in British Columbia. We deliver personalized service that fits into your busy life.

Expertly crafted insurance solutions uniquely tailored to meet your specific lifestyle and coverage needs effectively.

Leverage our local knowledge to secure insurance that's suited for British Columbia’s unique market conditions.

Explore a wide range of personal and commercial insurance products, all through one comprehensive policy.

Committed to outstanding customer service, we ensure continuous support, making your experience stress-free.

Experience savings on your premiums with our competitive pricing without sacrificing the quality of your coverage.

Our team of professionals brings 30+ years of expertise to guide you through the insurance selection process.

In partnership with top insurers, we provide robust, reliable coverage tailored to meet your unique needs.

Open daily, with extended hours across multiple locations for easy access to our insurance services at your convenience.

Getting You The Best Quote

We work with trusted insurance companies to compare the best coverage and rates. Our team helps you save by offering tailored solutions that can beat your current policy and provide great value for your needs.

Trusted by Our Clients

See what our clients say about S&S Insurance—personalized service, expert advice, and unbeatable savings. Real experiences from satisfied customers who trust us to protect their home, business, and assets.

Stay informed with expert advice on insurance trends, coverage tips, and ways to save money. Our blog features articles that help you make smarter decisions about protecting your home, car, business, and more.

If you drive in British Columbia, you know ICBC’s Basic Autoplan is mandatory. But do you know what it actually covers—and where it stops? Understanding

Learn about EV insurance in Surrey. Discover coverage options, costs, and incentives to protect your electric vehicle investment.

Discover the benefits of tenant insurance for Surrey renters. Affordable and essential for secure renting.

Discover must-know travel insurance tips for Surrey residents. Stay protected on your trips with the right coverage and expert advice.

Protect your Surrey, BC home with flood insurance. Learn about costs, risks, and coverage to safeguard against unexpected flood damage.

Learn about what impacts home insurance premiums in Surrey, and learn strategies to reduce costs and maximize savings.