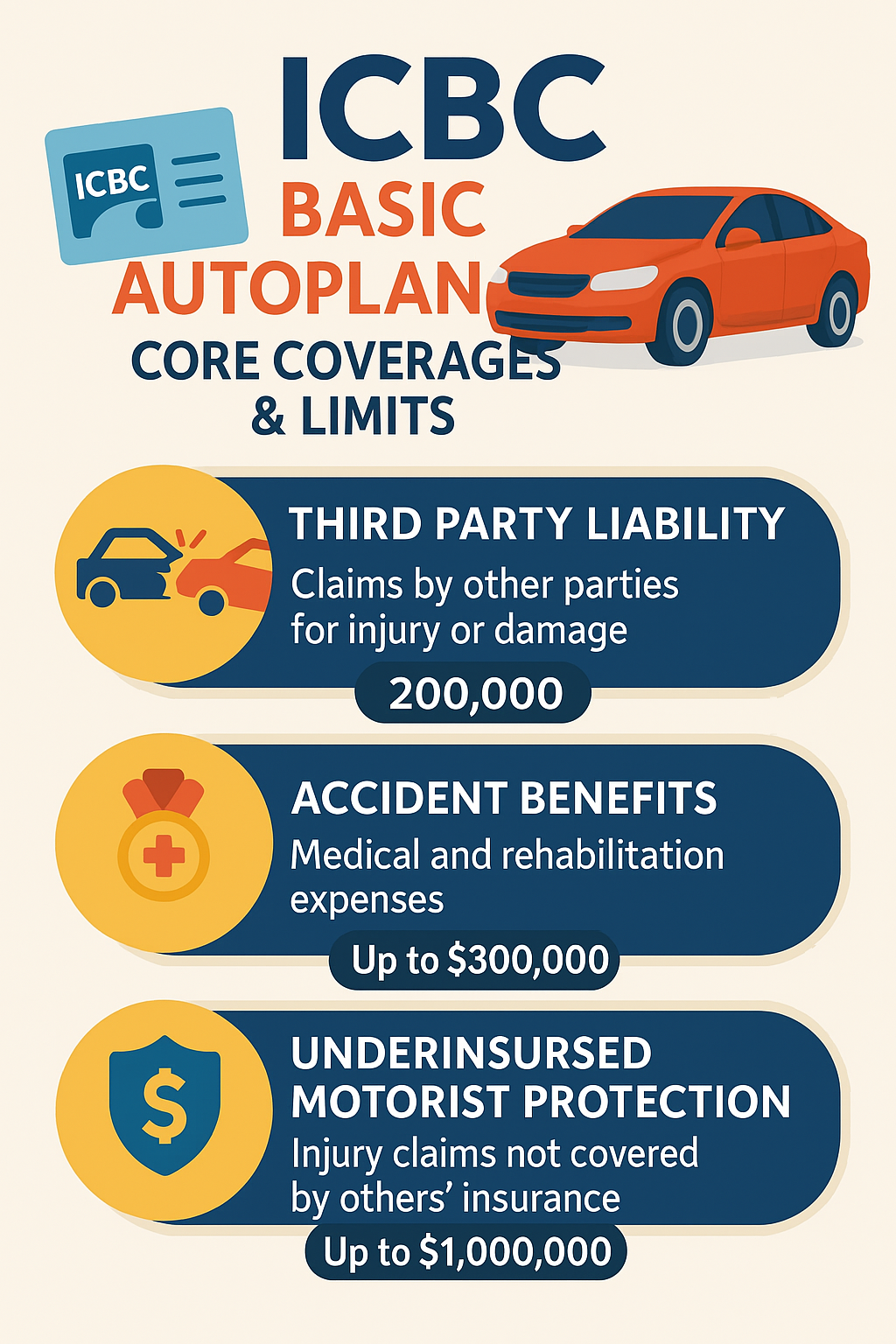

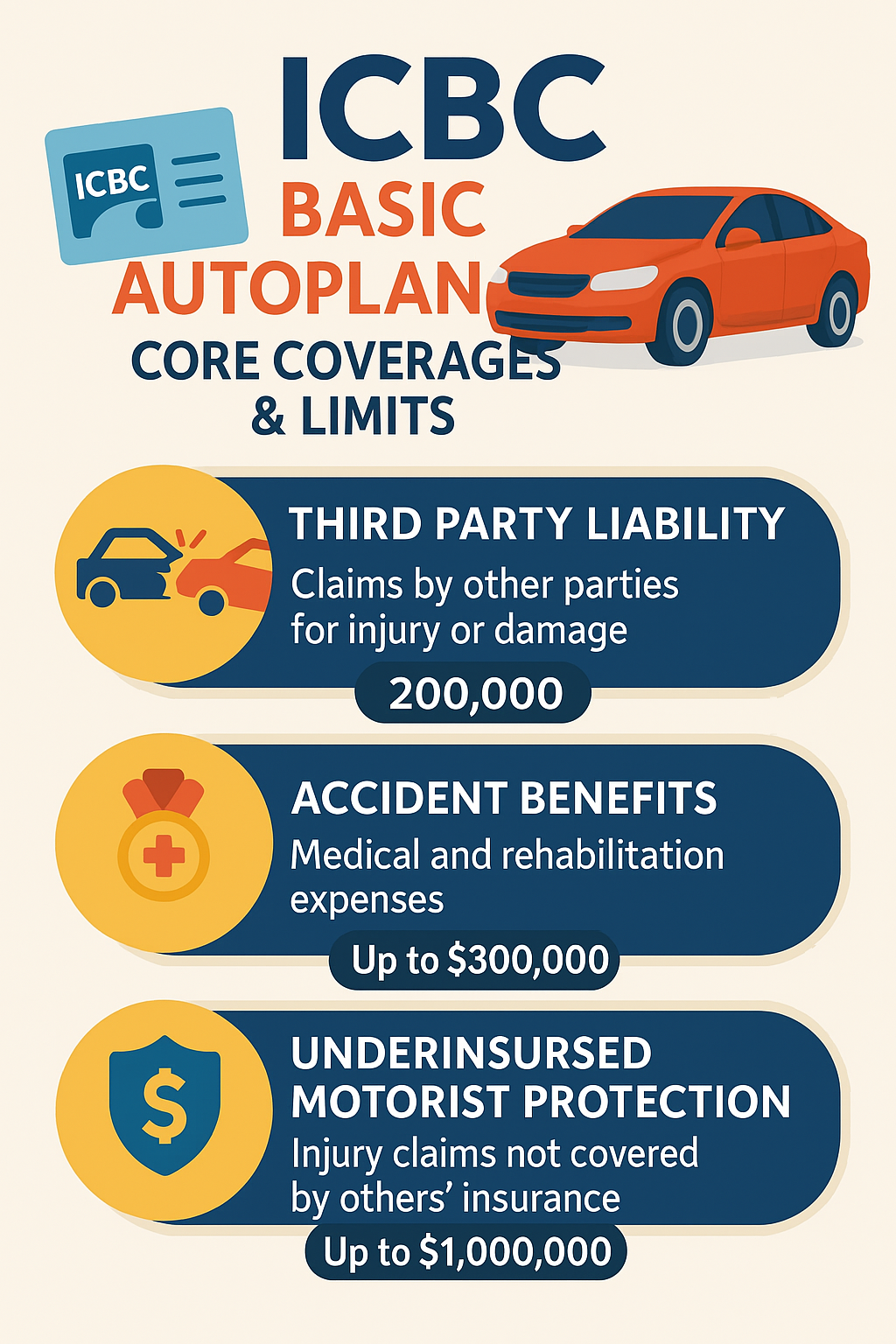

🚗 ICBC Basic Autoplan: Core Coverages & Limits 🇨🇦

If you drive in British Columbia, you know ICBC’s Basic Autoplan is mandatory. But do you know what it actually covers—and where it stops? Understanding

Get the most competitive quote from us. We have helped save 1000s of dollars for our clients.

S & S Insurance For Farms

Jump To Section:

Comprehensive Solutions To Protect You

Running a farm in British Columbia comes with many daily risks. Weather events, equipment breakdowns, livestock illness, or unexpected accidents can quickly disrupt operations and income. As an experienced insurance broker, we help farmers identify these vulnerabilities and provide protection through customized farm insurance solutions. Whether you manage a small family operation or a large commercial farm, coverage can include your buildings, machinery, vehicles, and livestock. With the right protection in place, you can operate confidently knowing your investment, property, and future are shielded from unforeseen setbacks. Our role is to simplify the insurance process and ensure each policy matches your farm’s specific risks.

Every farm has unique coverage requirements depending on its size, products, and operations. We work closely with farm owners across British Columbia to develop comprehensive insurance plans that grow with their business. Coverage options can include farm property, equipment, and crop protection, as well as liability for employees, visitors, or third-party damage. Livestock and produce insurance also help protect valuable inventory against disease or contamination. We partner with leading Canadian insurers to offer flexible policies that balance affordability with strong protection. Our goal is to make sure you never face financial strain after unexpected loss, giving you peace of mind through every season and harvest.

Farm insurance is designed to respond when unexpected losses occur. Common claims include damage from windstorms, fires, or floods that affect barns, equipment, or harvest-ready crops. Machinery breakdown or theft can also interrupt operations, while liability claims may arise if someone is injured on the property or if products cause harm after sale. In these situations, your insurance provider helps cover repair or replacement costs, lost income, and potential legal expenses. As your insurance broker, we assist from the first notice of loss to claim resolution, ensuring the process is smooth and fair. Our experience handling farm-specific claims helps minimize downtime and financial stress so you can focus on getting back to business quickly.

Coverages Available For You

Business insurance safeguards against unexpected incidents like property damage or legal claims. Protect your company’s future with tailored insurance solutions.

Business interruption insurance replaces lost income and covers expenses when your BC business is forced to close due to a covered event like fire or natural disaster.

Business liability insurance protects BC companies from financial losses due to lawsuits, covering legal costs and damages for third-party injuries or property damage.

Comprehensive insurance protecting goods in transit and storage, ensuring your cargo and stock are covered against loss, damage, or theft worldwide.

Commercial auto insurance covers vehicles used for business purposes, protecting against liability, damages, and accidents involving your company’s cars, trucks, or vans.

Protect your business assets with comprehensive coverage for property damage and loss.

Employment Practices Liability Insurance (EPLI) protects businesses in British Columbia against employee claims related to discrimination, wrongful termination, and harassment.

Protect your business assets with comprehensive equipment breakdown insurance, covering mechanical and electrical malfunctions.

Protect your farming operation in British Columbia with tailored farm insurance, safeguarding against risks like crop loss, equipment failure, and liability claims.

Fleet Insurance covers multiple business vehicles under one policy, protecting against liabilities like accidents, theft, and damage.

Explore comprehensive Group Benefits in British Columbia, designed to support employee health, wellness, and financial security through tailored insurance plans.

Auto insurance in BC covers your vehicle and protects against risks like accidents, theft, and third-party liability, ensuring safe and compliant driving.

Commonly Asked Questions

Discover our streamlined insurance process designed to be quick and straightforward. From initial quote to policy purchase, we guide you through every step to ensure your complete satisfaction.

Begin with your information to get a detailed insurance quote.

We’ll gather your personal or business information through our secure form to create an insurance quote just for you.

Review coverage choices from different providers and choose the best one.

We’ll guide you through comparing insurance options, helping you select the plan that best matches your coverage needs and budget.

We’ll help you secure your policy quickly, providing immediate access to your documents and full dedicated support.

Our team of experts specializes in home, auto, business, life, travel insurance, and more, providing you with tailored guidance to ensure you receive the best possible coverage.

S&S stands apart with a blend of local expertise and personal commitment, creating insurance solutions that resonate with your needs in British Columbia. We deliver personalized service that fits into your busy life.

Expertly crafted insurance solutions uniquely tailored to meet your specific lifestyle and coverage needs effectively.

Leverage our local knowledge to secure insurance that's suited for British Columbia’s unique market conditions.

Explore a wide range of personal and commercial insurance products, all through one comprehensive policy.

Committed to outstanding customer service, we ensure continuous support, making your experience stress-free.

Experience savings on your premiums with our competitive pricing without sacrificing the quality of your coverage.

Our team of professionals brings 30+ years of expertise to guide you through the insurance selection process.

In partnership with top insurers, we provide robust, reliable coverage tailored to meet your unique needs.

Open daily, with extended hours across multiple locations for easy access to our insurance services at your convenience.

Getting You The Best Quote

We work with trusted insurance companies to compare the best coverage and rates. Our team helps you save by offering tailored solutions that can beat your current policy and provide great value for your needs.

Trusted by Our Clients

See what our clients say about S&S Insurance—personalized service, expert advice, and unbeatable savings. Real experiences from satisfied customers who trust us to protect their home, business, and assets.

Stay informed with expert advice on insurance trends, coverage tips, and ways to save money. Our blog features articles that help you make smarter decisions about protecting your home, car, business, and more.

If you drive in British Columbia, you know ICBC’s Basic Autoplan is mandatory. But do you know what it actually covers—and where it stops? Understanding

Learn about EV insurance in Surrey. Discover coverage options, costs, and incentives to protect your electric vehicle investment.

Discover the benefits of tenant insurance for Surrey renters. Affordable and essential for secure renting.

Discover must-know travel insurance tips for Surrey residents. Stay protected on your trips with the right coverage and expert advice.

Protect your Surrey, BC home with flood insurance. Learn about costs, risks, and coverage to safeguard against unexpected flood damage.

Learn about what impacts home insurance premiums in Surrey, and learn strategies to reduce costs and maximize savings.