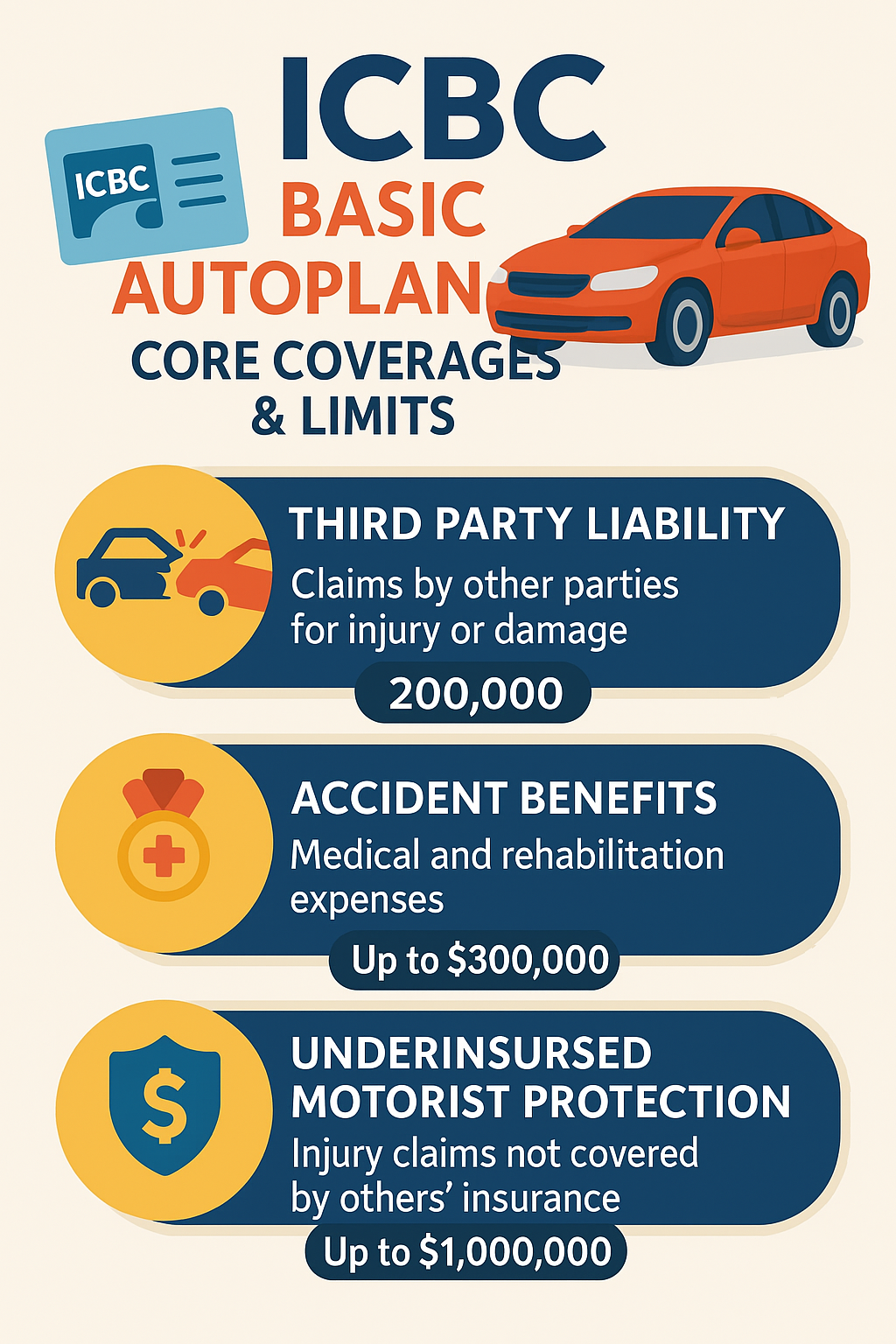

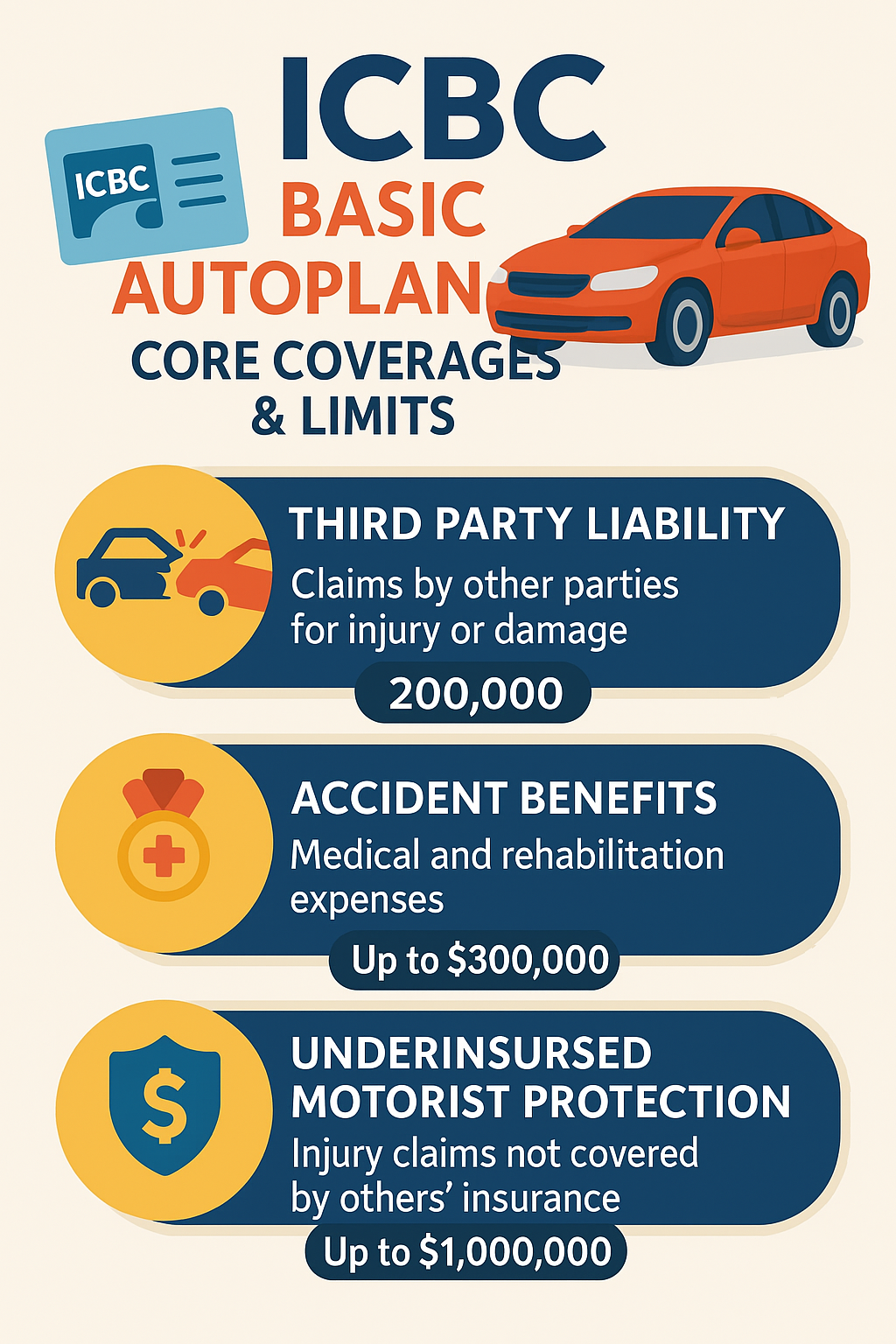

🚗 ICBC Basic Autoplan: Core Coverages & Limits 🇨🇦

If you drive in British Columbia, you know ICBC’s Basic Autoplan is mandatory. But do you know what it actually covers—and where it stops? Understanding

Get the most competitive quote from us. We have helped save 1000s of dollars for our clients.

S & S Insurance For Manufactured home parks

Jump To Section:

Comprehensive Solutions To Protect You

Manufactured home parks face daily risks that can quickly become costly if insurance is not properly structured. Fire, wind, snow load and winter pipe bursts can damage homes, park-owned buildings, utility lines and common areas, while aging infrastructure increases the chance of water, sewer and electrical failures. As your insurance broker, the first step is understanding your park layout, occupancy, age of units and critical systems so coverage limits and deductibles align with real-world replacement costs. Policies can be designed to protect park-owned property, site infrastructure, signage, fences and shared facilities, along with commercial general liability for injuries or property damage involving tenants, guests or contractors. The goal is straightforward: build a practical, affordable safety net around the risks you manage every single day.

Comprehensive insurance for manufactured home parks in BC typically combines several policy components into one coordinated program. Property insurance can cover park-owned buildings, utility sheds, office structures, roads, and key infrastructure such as water, sewer and electrical distribution systems, subject to policy terms. Commercial general liability responds to third-party bodily injury or property damage claims arising from slips and falls in common areas, trees or signage falling, or alleged negligence in park maintenance. Business interruption or loss of rental income coverage helps replace lost pad fees if an insured event forces homes to be vacated or sections of the park to close while repairs are completed. Optional enhancements can include equipment breakdown, crime coverage, flood or earthquake options, and higher liability limits to satisfy lenders or regulatory expectations.

Manufactured home parks in British Columbia see several recurring claim scenarios that highlight why tailored coverage is essential. Fire losses, whether starting in a unit, park-owned building or utility shed, can trigger property claims for structural damage, debris removal, and repairs to impacted infrastructure. Windstorms or heavy snow may damage roofs, carports, trees and power lines, leading to claims for property repairs and additional living expenses if residents must temporarily relocate. Water-related incidents such as burst pipes, failed connections or sewer backups can affect multiple pads at once, with coverage responding to repair damaged areas and, where included, handle loss of rental income. Liability claims can arise from slips and falls, fallen trees, unsafe common areas or maintenance disputes, with commercial general liability paying for legal defence and eligible settlements or judgments, subject to limits and deductibles.

Coverages Available For You

Business insurance safeguards against unexpected incidents like property damage or legal claims. Protect your company’s future with tailored insurance solutions.

Business interruption insurance replaces lost income and covers expenses when your BC business is forced to close due to a covered event like fire or natural disaster.

Business liability insurance protects BC companies from financial losses due to lawsuits, covering legal costs and damages for third-party injuries or property damage.

Protect your business in British Columbia with tailored commercial insurance that covers liability, property damage, and more, ensuring peace of mind for entrepreneurs. Commercial insurance implies a broader umbrella covering larger enterprises, complex industrial operations, or specialized fleets. It frequently refers to “Commercial Package Policies” (CPP) that allow companies to bundle complex coverages (like liability, property, and fleet) à la carte with higher limits.

Protect your business assets with comprehensive coverage for property damage and loss.

Protect your leadership with Directors & Officers insurance in BC. Safeguard personal assets and decision-making from legal challenges in today’s complex business environment.

Employment Practices Liability Insurance (EPLI) protects businesses in British Columbia against employee claims related to discrimination, wrongful termination, and harassment.

Protect your business assets with comprehensive equipment breakdown insurance, covering mechanical and electrical malfunctions.

Explore comprehensive Group Benefits in British Columbia, designed to support employee health, wellness, and financial security through tailored insurance plans.

Marine liability insurance protects businesses against legal liabilities from marine operations, covering third-party claims for injury, property damage, and pollution.

Pollution liability insurance in British Columbia protects businesses from environmental risks, covering costs related to pollution incidents and safeguarding against legal claims.

Rental property insurance in BC protects landlords from financial losses due to property damage, liability claims, and loss of rental income.

Commonly Asked Questions

Discover our streamlined insurance process designed to be quick and straightforward. From initial quote to policy purchase, we guide you through every step to ensure your complete satisfaction.

Begin with your information to get a detailed insurance quote.

We’ll gather your personal or business information through our secure form to create an insurance quote just for you.

Review coverage choices from different providers and choose the best one.

We’ll guide you through comparing insurance options, helping you select the plan that best matches your coverage needs and budget.

We’ll help you secure your policy quickly, providing immediate access to your documents and full dedicated support.

Our team of experts specializes in home, auto, business, life, travel insurance, and more, providing you with tailored guidance to ensure you receive the best possible coverage.

S&S stands apart with a blend of local expertise and personal commitment, creating insurance solutions that resonate with your needs in British Columbia. We deliver personalized service that fits into your busy life.

Expertly crafted insurance solutions uniquely tailored to meet your specific lifestyle and coverage needs effectively.

Leverage our local knowledge to secure insurance that's suited for British Columbia’s unique market conditions.

Explore a wide range of personal and commercial insurance products, all through one comprehensive policy.

Committed to outstanding customer service, we ensure continuous support, making your experience stress-free.

Experience savings on your premiums with our competitive pricing without sacrificing the quality of your coverage.

Our team of professionals brings 30+ years of expertise to guide you through the insurance selection process.

In partnership with top insurers, we provide robust, reliable coverage tailored to meet your unique needs.

Open daily, with extended hours across multiple locations for easy access to our insurance services at your convenience.

Getting You The Best Quote

We work with trusted insurance companies to compare the best coverage and rates. Our team helps you save by offering tailored solutions that can beat your current policy and provide great value for your needs.

Trusted by Our Clients

See what our clients say about S&S Insurance—personalized service, expert advice, and unbeatable savings. Real experiences from satisfied customers who trust us to protect their home, business, and assets.

Stay informed with expert advice on insurance trends, coverage tips, and ways to save money. Our blog features articles that help you make smarter decisions about protecting your home, car, business, and more.

If you drive in British Columbia, you know ICBC’s Basic Autoplan is mandatory. But do you know what it actually covers—and where it stops? Understanding

Learn about EV insurance in Surrey. Discover coverage options, costs, and incentives to protect your electric vehicle investment.

Discover the benefits of tenant insurance for Surrey renters. Affordable and essential for secure renting.

Discover must-know travel insurance tips for Surrey residents. Stay protected on your trips with the right coverage and expert advice.

Protect your Surrey, BC home with flood insurance. Learn about costs, risks, and coverage to safeguard against unexpected flood damage.

Learn about what impacts home insurance premiums in Surrey, and learn strategies to reduce costs and maximize savings.