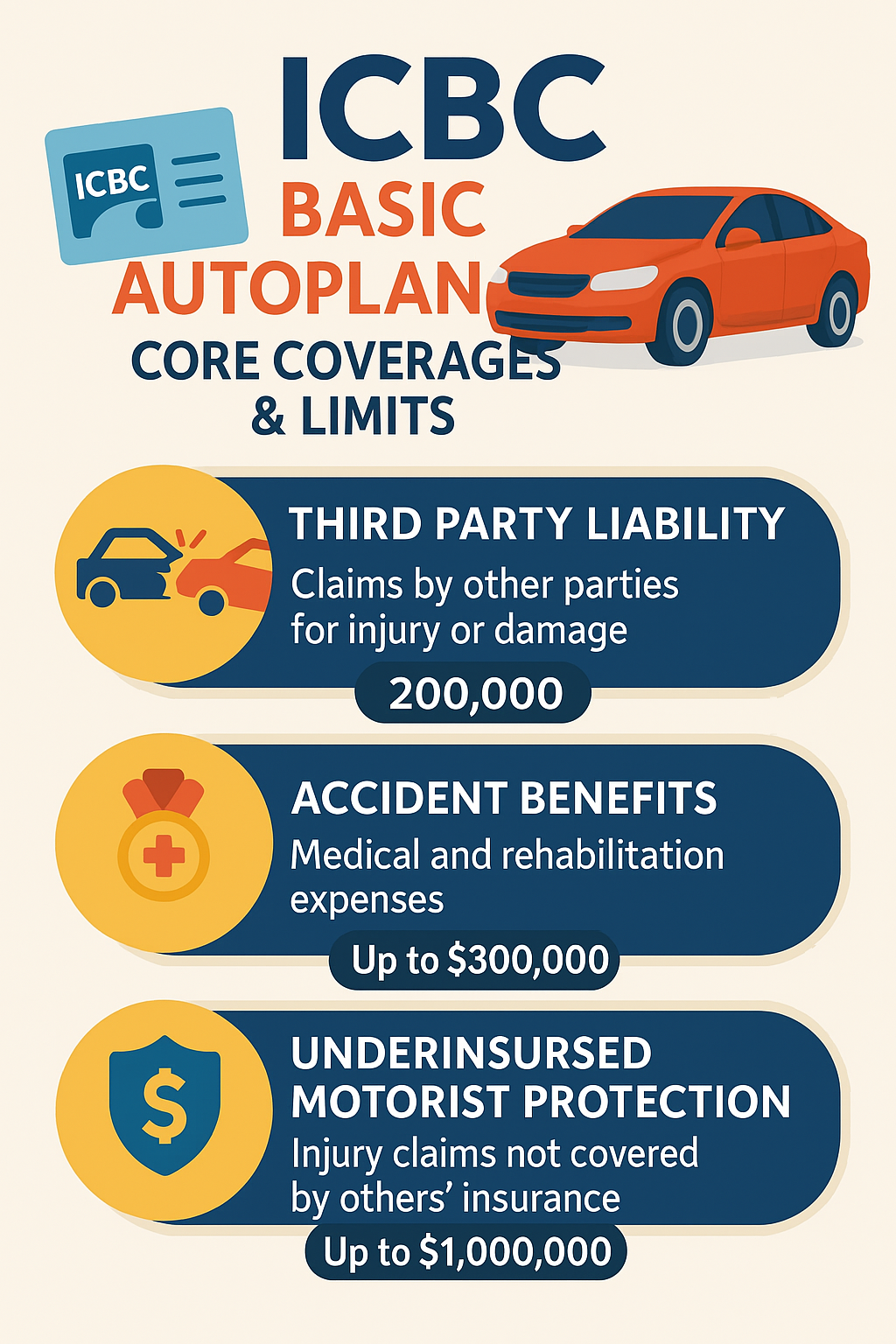

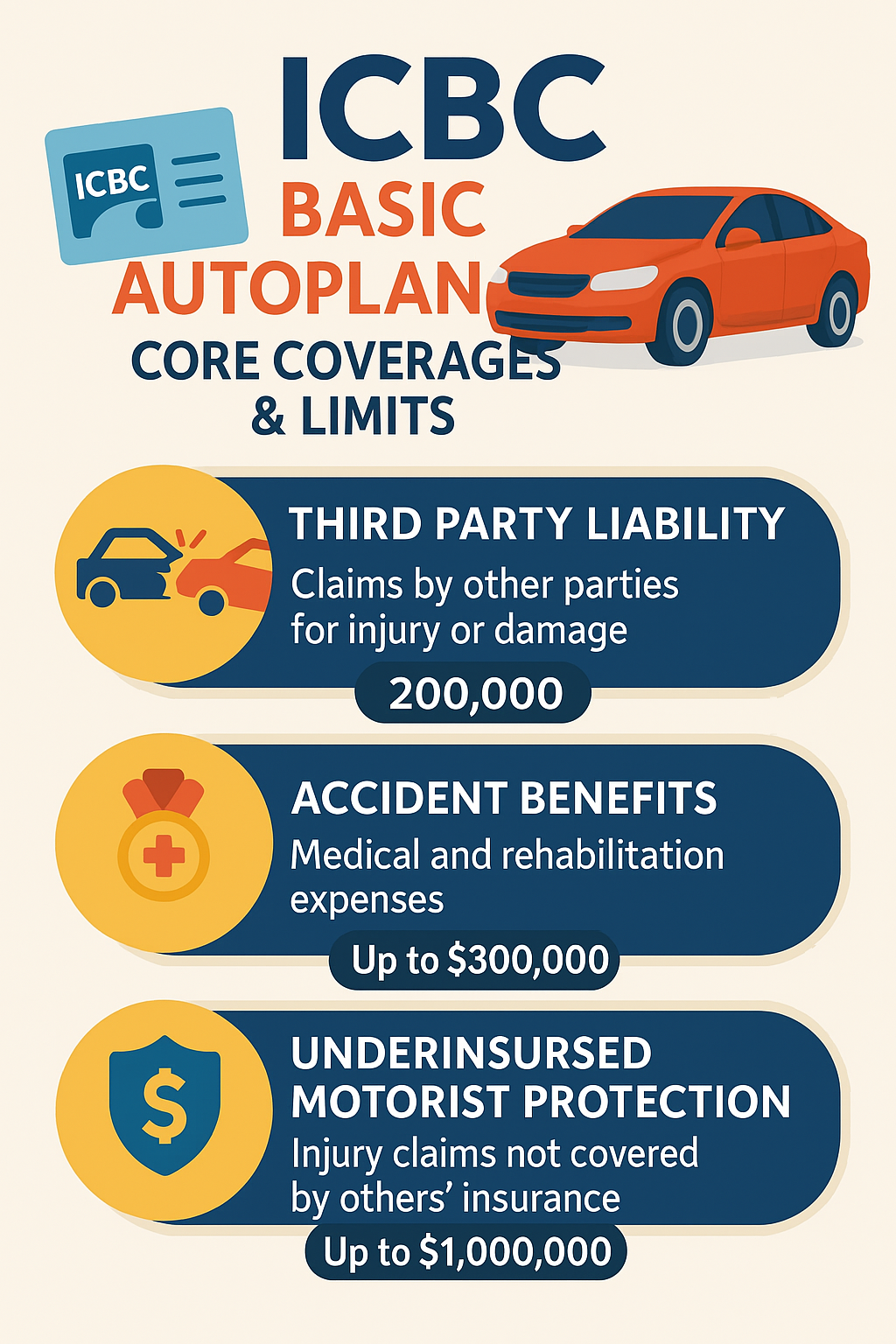

🚗 ICBC Basic Autoplan: Core Coverages & Limits 🇨🇦

If you drive in British Columbia, you know ICBC’s Basic Autoplan is mandatory. But do you know what it actually covers—and where it stops? Understanding

Get the most competitive quote from us. We have helped save 1000s of dollars for our clients.

S & S Insurance For Mechanics

Jump To Section:

Comprehensive Solutions To Protect You

Every day, mechanics in British Columbia face risks that can shut down a busy shop in seconds. A customer could slip on an oily floor, a vehicle might be damaged during a road test, or a fire could destroy tools and equipment you rely on. As your insurance broker, we look closely at how your shop runs and identify the everyday exposures you may not see. We help protect your building, customer vehicles, specialized tools, diagnostic equipment, and liability if someone is injured or property is damaged. We can also address employee injuries, theft, and vandalism that threaten your income. With the right coverage in place, you can focus on fixing vehicles and serving customers, knowing a solid insurance plan is working quietly in the background to support your business.

No two mechanical shops in B.C. are exactly alike, so your insurance shouldn’t be either. We start by understanding your services-from basic oil changes and brake work to diagnostics, custom builds, fleet maintenance, or mobile repairs. Then we assemble a package that can include commercial general liability, garage liability, property coverage for your building and contents, tool and equipment coverage, crime and cyber protection, and commercial vehicle insurance for service trucks or courtesy cars. We can also arrange business interruption coverage to help replace lost income if a covered claim forces you to temporarily close. By comparing options from multiple insurers, we help you avoid gaps, minimize exclusions, and balance deductibles with premiums, so your coverage actually reflects the way your mechanical business operates today and where you plan to grow tomorrow.

Claims can happen suddenly, even in a well-run shop. A customer’s vehicle may be scratched during a repair, a technician could accidentally install a faulty part that causes engine damage, or a break-in might result in stolen tools and diagnostic equipment. In more serious cases, a customer or employee could be injured on site or during a road test. With the right insurance in place, garage liability can respond to damage to customer vehicles, while general liability can address third-party injury or property claims. Property insurance helps repair or replace damaged buildings, contents, and tools, and business interruption coverage can support ongoing expenses while you recover. As your broker, we guide you through reporting the claim, dealing with adjusters, and understanding what is covered, so you are not handling it alone.

Coverages Available For You

Bailee’s customer insurance protects businesses in British Columbia from liability for damages to customer property while in their care, ensuring peace of mind.

Business insurance safeguards against unexpected incidents like property damage or legal claims. Protect your company’s future with tailored insurance solutions.

Business interruption insurance replaces lost income and covers expenses when your BC business is forced to close due to a covered event like fire or natural disaster.

Business liability insurance protects BC companies from financial losses due to lawsuits, covering legal costs and damages for third-party injuries or property damage.

Commercial auto insurance covers vehicles used for business purposes, protecting against liability, damages, and accidents involving your company’s cars, trucks, or vans.

Protect your business assets with comprehensive coverage for property damage and loss.

Protect your condo in British Columbia with comprehensive insurance that covers personal belongings, liability, and additional living expenses, ensuring peace of mind.

Commonly Asked Questions

Begin with your information to get a detailed insurance quote.

We’ll gather your personal or business information through our secure form to create an insurance quote just for you.

Review coverage choices from different providers and choose the best one.

We’ll guide you through comparing insurance options, helping you select the plan that best matches your coverage needs and budget.

We’ll help you secure your policy quickly, providing immediate access to your documents and full dedicated support.

Our team of experts specializes in home, auto, business, life, travel insurance, and more, providing you with tailored guidance to ensure you receive the best possible coverage.

Expertly crafted insurance solutions uniquely tailored to meet your specific lifestyle and coverage needs effectively.

Leverage our local knowledge to secure insurance that's suited for British Columbia’s unique market conditions.

Explore a wide range of personal and commercial insurance products, all through one comprehensive policy.

Committed to outstanding customer service, we ensure continuous support, making your experience stress-free.

Experience savings on your premiums with our competitive pricing without sacrificing the quality of your coverage.

Our team of professionals brings 30+ years of expertise to guide you through the insurance selection process.

In partnership with top insurers, we provide robust, reliable coverage tailored to meet your unique needs.

Open daily, with extended hours across multiple locations for easy access to our insurance services at your convenience.

Getting You The Best Quote

Trusted by Our Clients

If you drive in British Columbia, you know ICBC’s Basic Autoplan is mandatory. But do you know what it actually covers—and where it stops? Understanding

Learn about EV insurance in Surrey. Discover coverage options, costs, and incentives to protect your electric vehicle investment.

Discover the benefits of tenant insurance for Surrey renters. Affordable and essential for secure renting.

Discover must-know travel insurance tips for Surrey residents. Stay protected on your trips with the right coverage and expert advice.

Protect your Surrey, BC home with flood insurance. Learn about costs, risks, and coverage to safeguard against unexpected flood damage.

Learn about what impacts home insurance premiums in Surrey, and learn strategies to reduce costs and maximize savings.