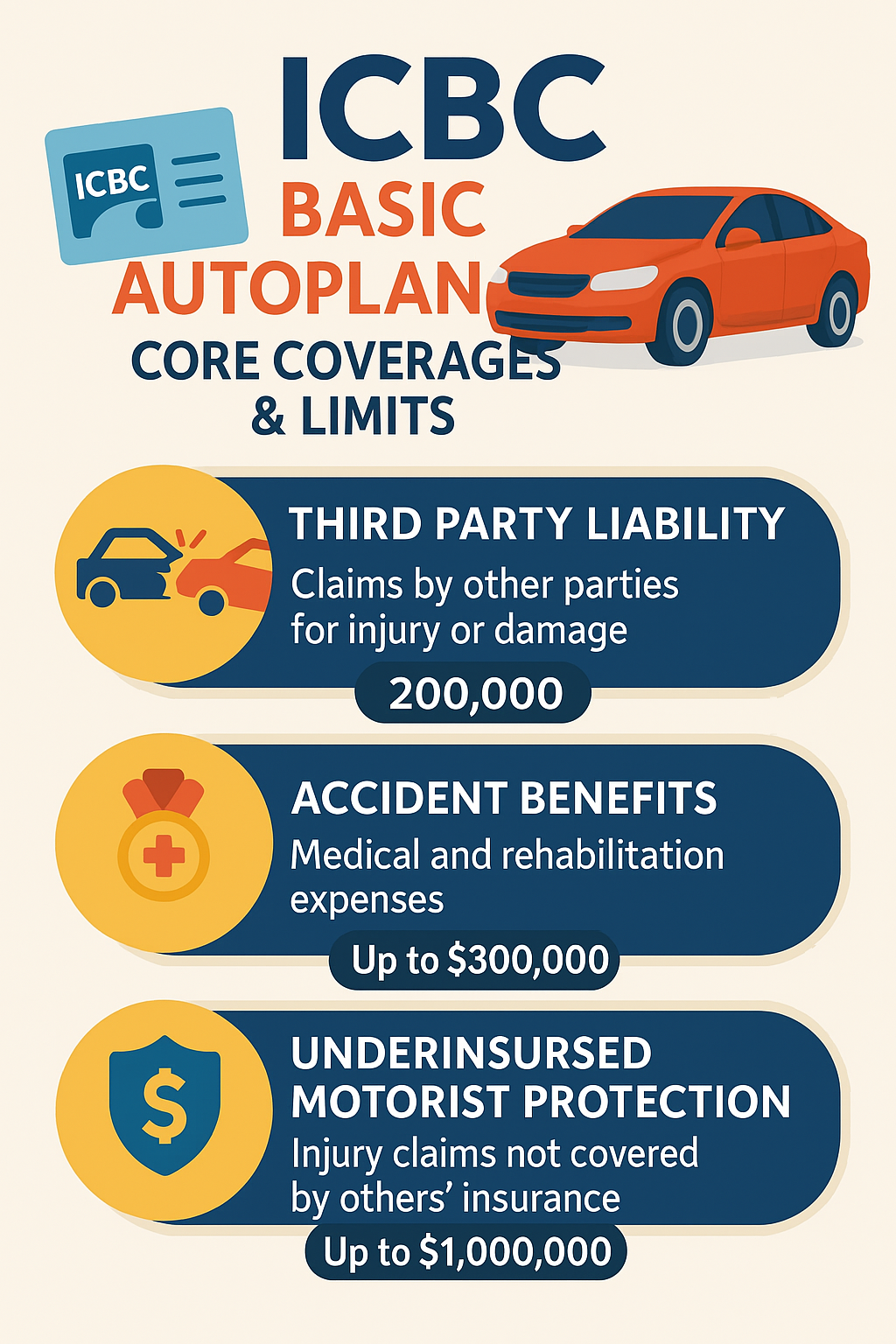

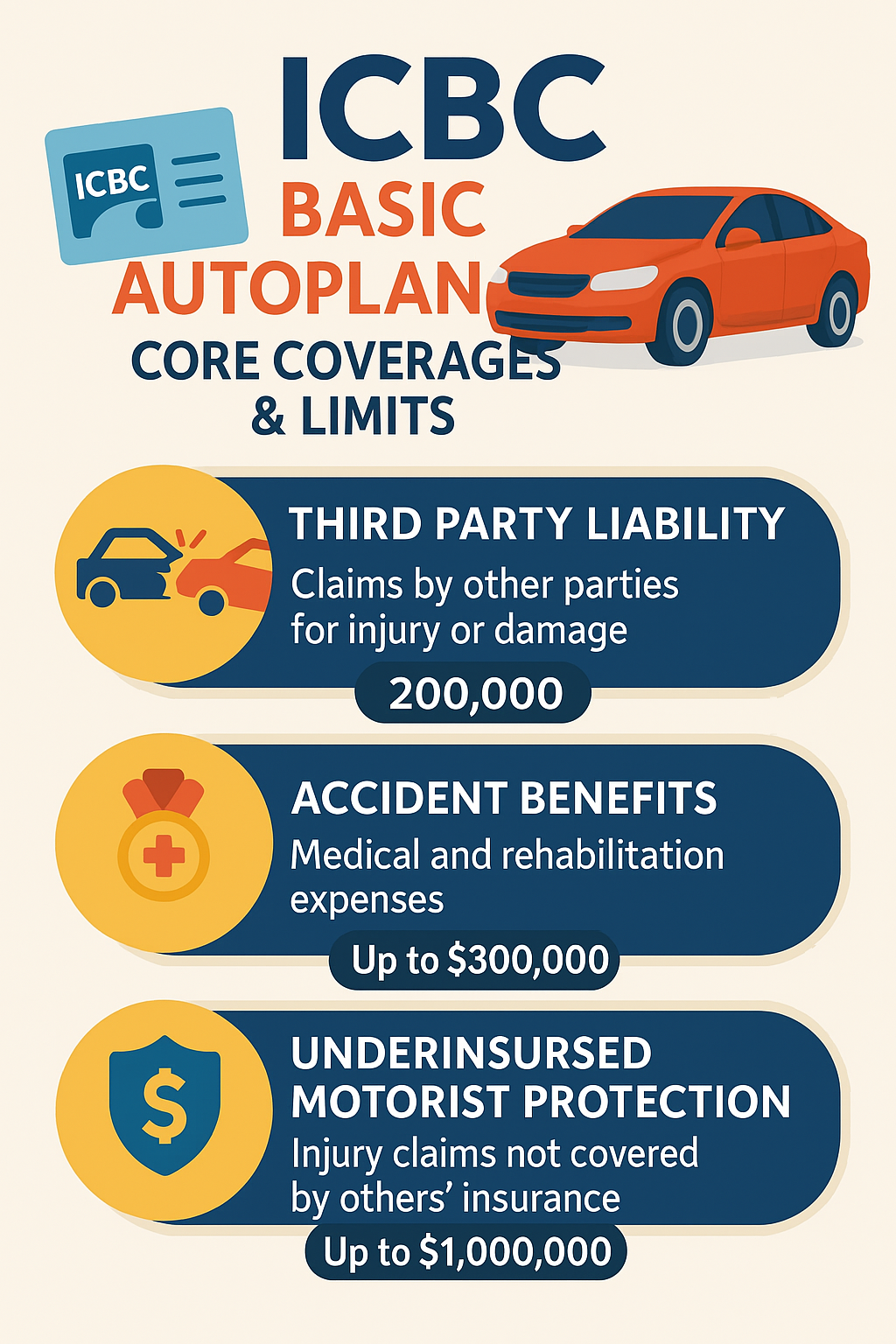

🚗 ICBC Basic Autoplan: Core Coverages & Limits 🇨🇦

If you drive in British Columbia, you know ICBC’s Basic Autoplan is mandatory. But do you know what it actually covers—and where it stops? Understanding

Get the most competitive quote from us. We have helped save 1000s of dollars for our clients.

S & S Insurance For Non Profit Organizations (NGO)

Jump To Section:

Comprehensive Solutions To Protect You

Non-profit organizations face many of the same risks as businesses—property damage, accidents, and liability claims—but with tighter budgets and community-driven goals, every loss matters more. Our role as your insurance partner is to design coverage that keeps your programs running even when the unexpected happens. Whether it’s an injury at a fundraiser, theft at your office, or equipment failure, having the right insurance ensures your resources stay focused on your mission. We help protect directors, volunteers, and staff from personal liability, offering confidence that your organization’s work can continue without unnecessary financial stress. By identifying potential exposures and tailoring coverage to your activities, we help reduce the uncertainties that could disrupt your important contributions to the community.

Every non-profit has unique responsibilities, from managing donations and volunteers to organizing public events or providing community services. Our insurance solutions cover those diverse risks with policies that address property, liability, cyber exposure, and governance issues alike. We help you combine essential protections—such as general liability, directors and officers (D&O) coverage, and event insurance—into a streamlined, affordable plan. Organizations that work in outreach, education, advocacy, or care services benefit from customized coverage built around their operations’ distinct needs. With our guidance, you gain clarity about coverage limits and claims processes, ensuring that your organization remains protected and compliant with regulatory or funding requirements. Our priority is giving you confidence that your insurance program evolves as your non-profit grows and your community impact expands.

Common claims facing non-profits often include event-related injuries, accidental property damage, volunteer incidents, or allegations against directors and board members. For example, a slip-and-fall during a charity event, a vehicle accident during volunteer transport, or a data breach involving donor information could all trigger costly losses. With the right insurance in place, these incidents are quickly managed, ensuring legal expenses, property repairs, and compensation costs are covered without draining organizational funds. Directors and Officers (D&O) insurance protects leadership against mismanagement allegations, while general liability defends against injury claims. Cyber and property coverage address modern risks that can interrupt operations. By anticipating these scenarios, we help non-profits in British Columbia stay resilient, protect their reputation, and continue serving communities effectively, even after a claim.

Coverages Available For You

Business insurance safeguards against unexpected incidents like property damage or legal claims. Protect your company’s future with tailored insurance solutions.

Business interruption insurance replaces lost income and covers expenses when your BC business is forced to close due to a covered event like fire or natural disaster.

Business liability insurance protects BC companies from financial losses due to lawsuits, covering legal costs and damages for third-party injuries or property damage.

Commercial auto insurance covers vehicles used for business purposes, protecting against liability, damages, and accidents involving your company’s cars, trucks, or vans.

Protect your business assets with comprehensive coverage for property damage and loss.

Cyber insurance in British Columbia safeguards businesses against financial losses from cyber incidents, ensuring protection from data breaches, extortion, and operational disruptions.

Protect your leadership with Directors & Officers insurance in BC. Safeguard personal assets and decision-making from legal challenges in today’s complex business environment.

Protect your BC business from professional negligence claims with comprehensive liability coverage. Get a free quote for tailored insurance today.

Commonly Asked Questions

Begin with your information to get a detailed insurance quote.

We’ll gather your personal or business information through our secure form to create an insurance quote just for you.

Review coverage choices from different providers and choose the best one.

We’ll guide you through comparing insurance options, helping you select the plan that best matches your coverage needs and budget.

We’ll help you secure your policy quickly, providing immediate access to your documents and full dedicated support.

Our team of experts specializes in home, auto, business, life, travel insurance, and more, providing you with tailored guidance to ensure you receive the best possible coverage.

Expertly crafted insurance solutions uniquely tailored to meet your specific lifestyle and coverage needs effectively.

Leverage our local knowledge to secure insurance that's suited for British Columbia’s unique market conditions.

Explore a wide range of personal and commercial insurance products, all through one comprehensive policy.

Committed to outstanding customer service, we ensure continuous support, making your experience stress-free.

Experience savings on your premiums with our competitive pricing without sacrificing the quality of your coverage.

Our team of professionals brings 30+ years of expertise to guide you through the insurance selection process.

In partnership with top insurers, we provide robust, reliable coverage tailored to meet your unique needs.

Open daily, with extended hours across multiple locations for easy access to our insurance services at your convenience.

Getting You The Best Quote

Trusted by Our Clients

If you drive in British Columbia, you know ICBC’s Basic Autoplan is mandatory. But do you know what it actually covers—and where it stops? Understanding

Learn about EV insurance in Surrey. Discover coverage options, costs, and incentives to protect your electric vehicle investment.

Discover the benefits of tenant insurance for Surrey renters. Affordable and essential for secure renting.

Discover must-know travel insurance tips for Surrey residents. Stay protected on your trips with the right coverage and expert advice.

Protect your Surrey, BC home with flood insurance. Learn about costs, risks, and coverage to safeguard against unexpected flood damage.

Learn about what impacts home insurance premiums in Surrey, and learn strategies to reduce costs and maximize savings.