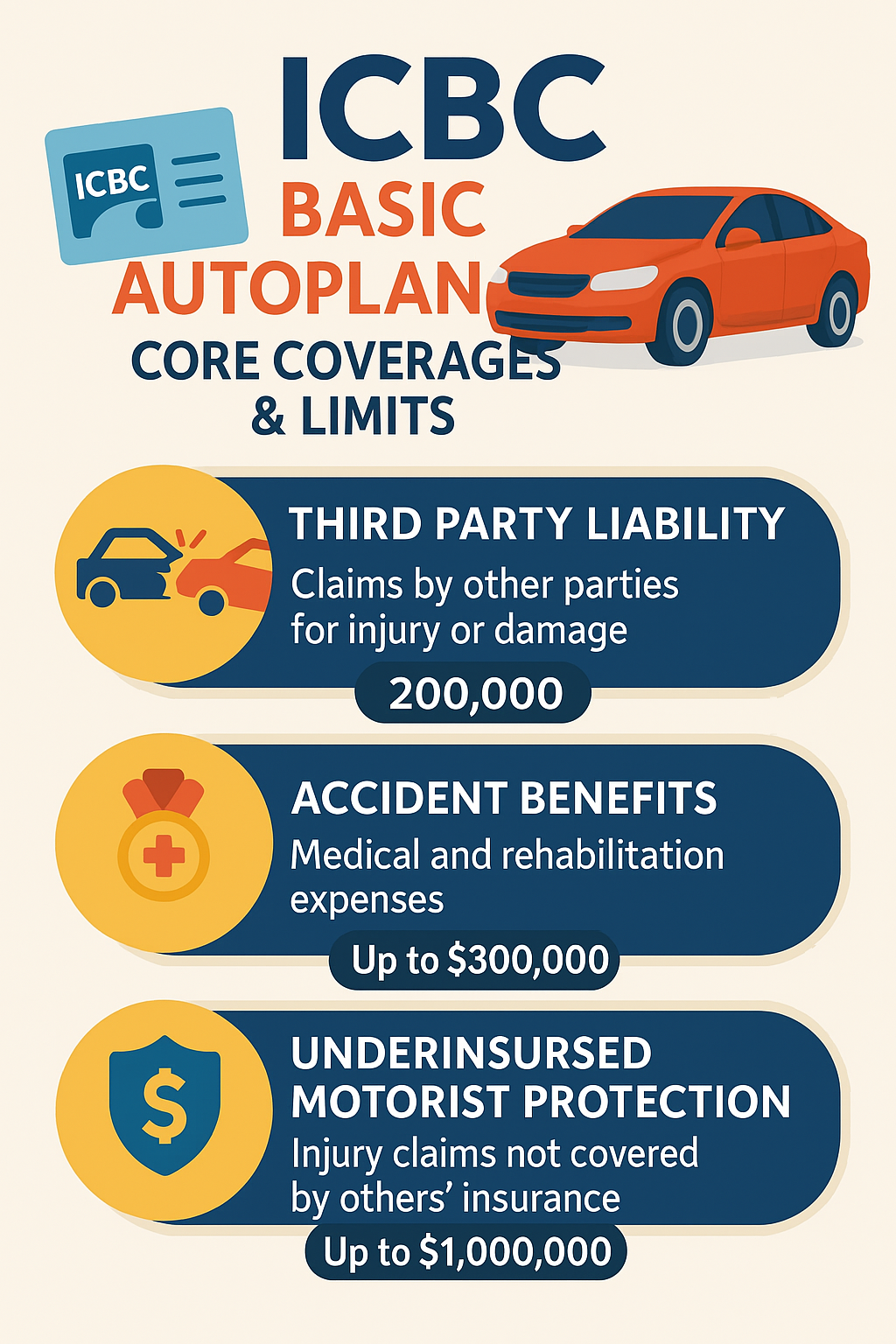

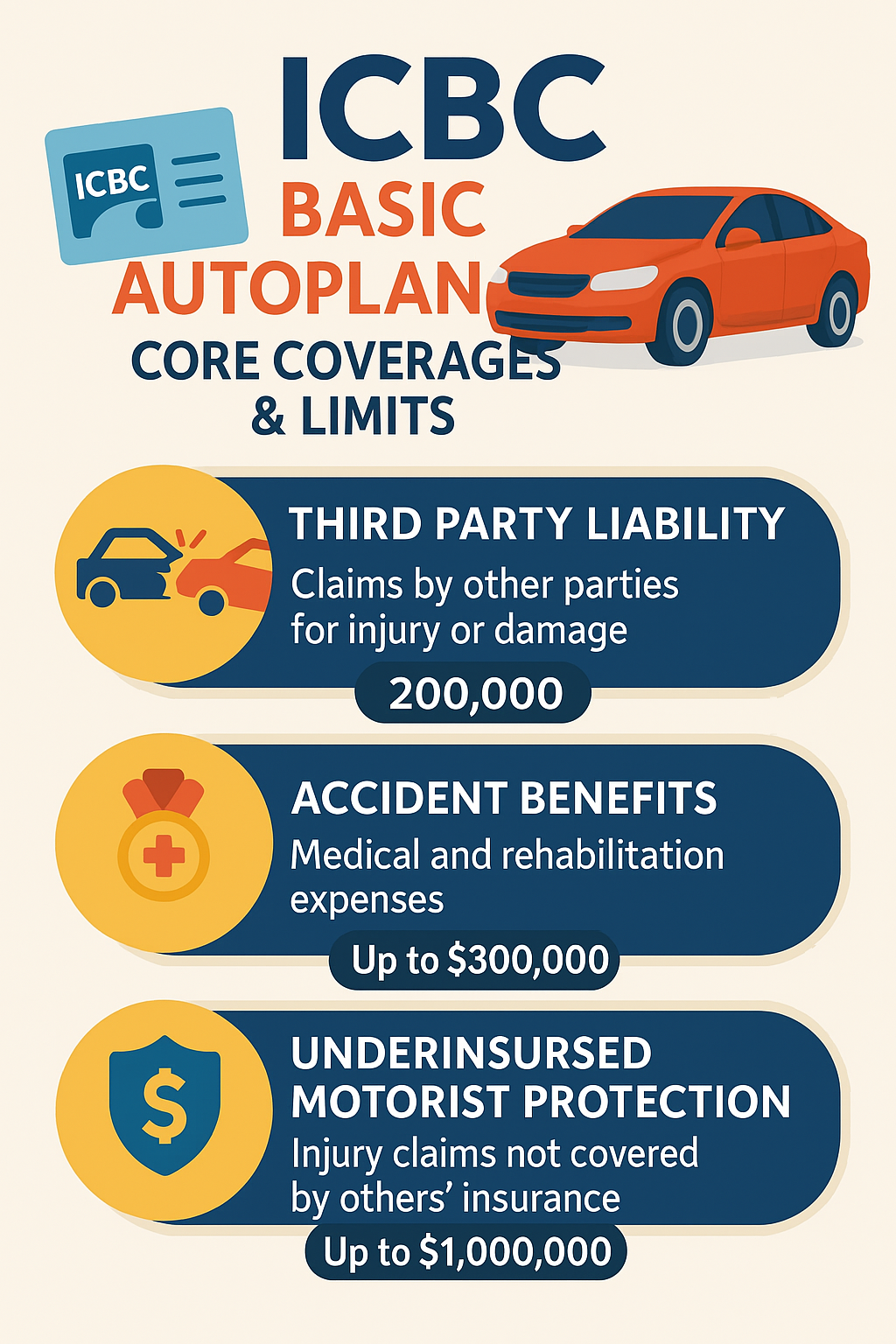

🚗 ICBC Basic Autoplan: Core Coverages & Limits 🇨🇦

If you drive in British Columbia, you know ICBC’s Basic Autoplan is mandatory. But do you know what it actually covers—and where it stops? Understanding

Get the most competitive quote from us. We have helped save 1000s of dollars for our clients.

S & S Insurance For Public Company Directors & Officers

Jump To Section:

Comprehensive Solutions To Protect You

Public companies face complex challenges where leadership decisions are constantly scrutinized. Directors and officers can be held personally liable for management decisions, even when acting in good faith. D&O Insurance helps protect their personal assets from the financial consequences of allegations such as misrepresentation, breach of duty, or regulatory non-compliance. In British Columbia’s evolving business and governance environment, this coverage is essential for attracting and retaining qualified executives. Our brokerage helps public companies identify exposures, secure comprehensive policies, and ensure coverage aligns with corporate governance standards. By providing expert risk assessment and ongoing policy management, we make sure your directors and officers remain protected from costly claims that could threaten both personal and corporate finances.

Our public company D&O solutions are designed to address the full spectrum of corporate governance risks. Policies typically cover directors, officers, and senior executives for claims made against them due to decisions impacting shareholders, regulators, or employees. Coverage extends to defense costs, settlements, and investigations involving securities litigation or regulatory enforcement. We partner with top Canadian insurers to offer flexible limits, worldwide protection, and options like Side A, B, and C coverage. Each policy is tailored to match your company’s operations, industry, and reporting obligations. With our proactive approach, your organization benefits from comprehensive protection that meets disclosure requirements and strengthens risk governance practices—giving leadership the confidence to operate decisively in a demanding regulatory environment.

Claims under public company D&O policies often arise from shareholder lawsuits alleging financial misstatements, errors in mergers or acquisitions, or failures in corporate disclosure. Other common claims involve regulatory investigations, employment practices disputes, and accusations of breach of fiduciary duty. In each case, D&O Insurance responds by funding legal defense, covering settlements, and preserving directors’ personal assets. Our brokerage ensures claims are managed efficiently by coordinating directly with insurers and legal counsel. We help executives understand coverage triggers, claim procedures, and the importance of timely reporting. This guided approach minimizes financial disruption and provides peace of mind when leadership faces complex or high-stakes allegations.

Coverages Available For You

Business insurance safeguards against unexpected incidents like property damage or legal claims. Protect your company’s future with tailored insurance solutions.

Business liability insurance protects BC companies from financial losses due to lawsuits, covering legal costs and damages for third-party injuries or property damage.

Protect your business in British Columbia with tailored commercial insurance that covers liability, property damage, and more, ensuring peace of mind for entrepreneurs. Commercial insurance implies a broader umbrella covering larger enterprises, complex industrial operations, or specialized fleets. It frequently refers to “Commercial Package Policies” (CPP) that allow companies to bundle complex coverages (like liability, property, and fleet) à la carte with higher limits.

Cyber insurance in British Columbia safeguards businesses against financial losses from cyber incidents, ensuring protection from data breaches, extortion, and operational disruptions.

Protect your leadership with Directors & Officers insurance in BC. Safeguard personal assets and decision-making from legal challenges in today’s complex business environment.

Protect your BC business from professional negligence claims with comprehensive liability coverage. Get a free quote for tailored insurance today.

Commonly Asked Questions

Begin with your information to get a detailed insurance quote.

We’ll gather your personal or business information through our secure form to create an insurance quote just for you.

Review coverage choices from different providers and choose the best one.

We’ll guide you through comparing insurance options, helping you select the plan that best matches your coverage needs and budget.

We’ll help you secure your policy quickly, providing immediate access to your documents and full dedicated support.

Our team of experts specializes in home, auto, business, life, travel insurance, and more, providing you with tailored guidance to ensure you receive the best possible coverage.

Expertly crafted insurance solutions uniquely tailored to meet your specific lifestyle and coverage needs effectively.

Leverage our local knowledge to secure insurance that's suited for British Columbia’s unique market conditions.

Explore a wide range of personal and commercial insurance products, all through one comprehensive policy.

Committed to outstanding customer service, we ensure continuous support, making your experience stress-free.

Experience savings on your premiums with our competitive pricing without sacrificing the quality of your coverage.

Our team of professionals brings 30+ years of expertise to guide you through the insurance selection process.

In partnership with top insurers, we provide robust, reliable coverage tailored to meet your unique needs.

Open daily, with extended hours across multiple locations for easy access to our insurance services at your convenience.

Getting You The Best Quote

Trusted by Our Clients

If you drive in British Columbia, you know ICBC’s Basic Autoplan is mandatory. But do you know what it actually covers—and where it stops? Understanding

Learn about EV insurance in Surrey. Discover coverage options, costs, and incentives to protect your electric vehicle investment.

Discover the benefits of tenant insurance for Surrey renters. Affordable and essential for secure renting.

Discover must-know travel insurance tips for Surrey residents. Stay protected on your trips with the right coverage and expert advice.

Protect your Surrey, BC home with flood insurance. Learn about costs, risks, and coverage to safeguard against unexpected flood damage.

Learn about what impacts home insurance premiums in Surrey, and learn strategies to reduce costs and maximize savings.