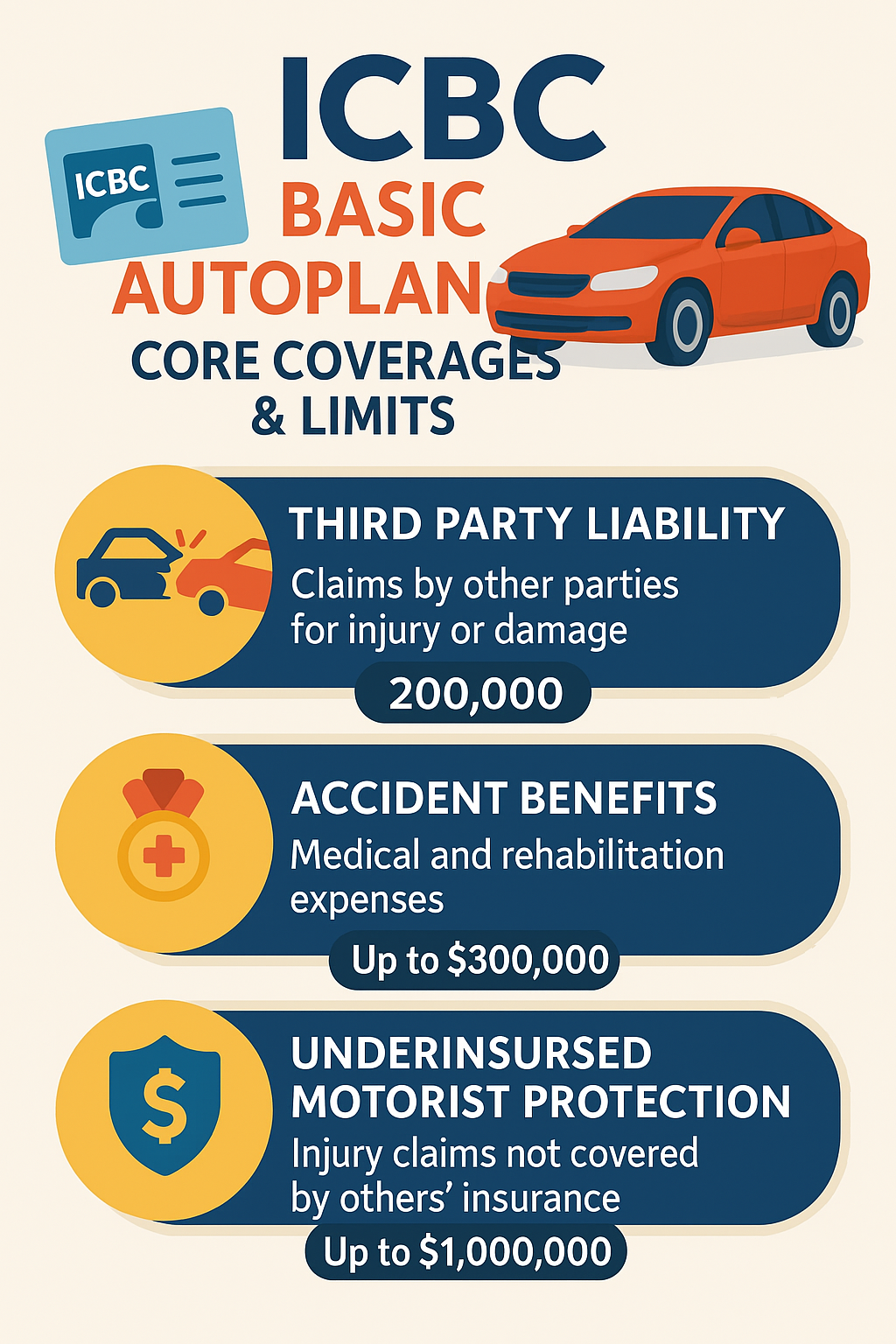

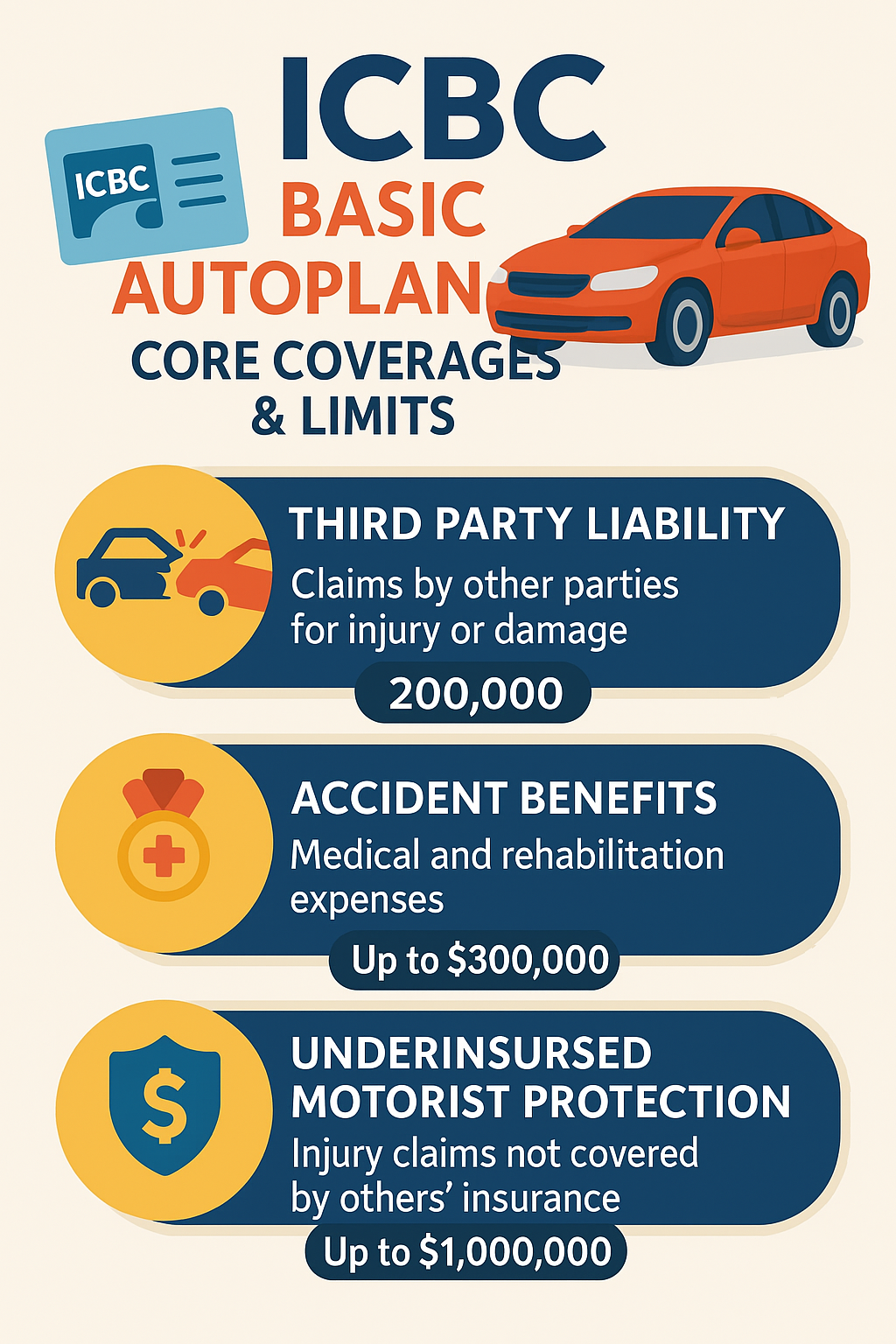

🚗 ICBC Basic Autoplan: Core Coverages & Limits 🇨🇦

If you drive in British Columbia, you know ICBC’s Basic Autoplan is mandatory. But do you know what it actually covers—and where it stops? Understanding

Get the most competitive quote from us. We have helped save 1000s of dollars for our clients.

S & S Insurance For Roofing Contractors Including Hot Tar Roofing

Jump To Section:

Comprehensive Solutions To Protect You

Roofing contractors face unique hazards every day, particularly those working with hot tar and open flames. Burns, fire damage, falling materials, and weather-related accidents are constant risks on job sites. Without proper coverage, even a minor incident can lead to major financial setbacks. Insurance for roofing contractors in British Columbia provides essential protection against third-party injuries, property damage, and on-site accidents. It also helps cover legal expenses and payout costs if a claim is filed against your business. Whether your team installs, repairs, or maintains roofs with traditional or hot tar systems, having the right insurance in place ensures your business stays operational and secure, no matter what challenges arise.

Each roofing operation requires different levels of protection depending on the services offered and project scale. Comprehensive insurance for roofing contractors typically includes general liability, commercial vehicle coverage, equipment insurance, property protection, and workers’ compensation. For hot tar roofing specialists, additional coverage for fire hazards, heat exposure, and chemical use provides greater security on the job. As an independent insurance broker, we compare policies from multiple Canadian insurers to match your business with the right coverage at the right price. Whether you manage residential, commercial, or industrial projects, we tailor insurance solutions to your exact needs, helping you meet regulatory requirements while minimizing exposure to costly claims or disruptions.

Roofing contractors frequently face claims involving property damage, injuries, or weather-related losses. For example, melting tar may cause a fire that damages a client’s building, or a worker could slip and suffer a serious injury. In these cases, general liability and workers’ compensation insurance help cover damages, legal costs, and medical expenses. Equipment insurance also protects the value of specialized tools lost or damaged on-site. If a project delay occurs due to weather or material loss, business interruption coverage can help offset lost income. By working with an experienced broker, roofing contractors gain the advantage of fast claim handling and dedicated support, ensuring incidents are resolved quickly so operations can continue without long-term setbacks.

Coverages Available For You

Bailee’s customer insurance protects businesses in British Columbia from liability for damages to customer property while in their care, ensuring peace of mind.

Business insurance safeguards against unexpected incidents like property damage or legal claims. Protect your company’s future with tailored insurance solutions.

Business interruption insurance replaces lost income and covers expenses when your BC business is forced to close due to a covered event like fire or natural disaster.

Business liability insurance protects BC companies from financial losses due to lawsuits, covering legal costs and damages for third-party injuries or property damage.

Commercial auto insurance covers vehicles used for business purposes, protecting against liability, damages, and accidents involving your company’s cars, trucks, or vans.

Protect your business assets with comprehensive coverage for property damage and loss.

Protect your construction business in British Columbia with tailored insurance solutions covering risks like accidents, theft, and property damage.

Contract surety insurance in British Columbia ensures contractors fulfill project obligations, providing financial protection to project owners against non-completion or substandard work.

Contractors’ liability insurance in British Columbia protects construction professionals from financial losses due to third-party claims for bodily injury or property damage.

Commonly Asked Questions

Begin with your information to get a detailed insurance quote.

We’ll gather your personal or business information through our secure form to create an insurance quote just for you.

Review coverage choices from different providers and choose the best one.

We’ll guide you through comparing insurance options, helping you select the plan that best matches your coverage needs and budget.

We’ll help you secure your policy quickly, providing immediate access to your documents and full dedicated support.

Our team of experts specializes in home, auto, business, life, travel insurance, and more, providing you with tailored guidance to ensure you receive the best possible coverage.

Expertly crafted insurance solutions uniquely tailored to meet your specific lifestyle and coverage needs effectively.

Leverage our local knowledge to secure insurance that's suited for British Columbia’s unique market conditions.

Explore a wide range of personal and commercial insurance products, all through one comprehensive policy.

Committed to outstanding customer service, we ensure continuous support, making your experience stress-free.

Experience savings on your premiums with our competitive pricing without sacrificing the quality of your coverage.

Our team of professionals brings 30+ years of expertise to guide you through the insurance selection process.

In partnership with top insurers, we provide robust, reliable coverage tailored to meet your unique needs.

Open daily, with extended hours across multiple locations for easy access to our insurance services at your convenience.

Getting You The Best Quote

Trusted by Our Clients

If you drive in British Columbia, you know ICBC’s Basic Autoplan is mandatory. But do you know what it actually covers—and where it stops? Understanding

Learn about EV insurance in Surrey. Discover coverage options, costs, and incentives to protect your electric vehicle investment.

Discover the benefits of tenant insurance for Surrey renters. Affordable and essential for secure renting.

Discover must-know travel insurance tips for Surrey residents. Stay protected on your trips with the right coverage and expert advice.

Protect your Surrey, BC home with flood insurance. Learn about costs, risks, and coverage to safeguard against unexpected flood damage.

Learn about what impacts home insurance premiums in Surrey, and learn strategies to reduce costs and maximize savings.