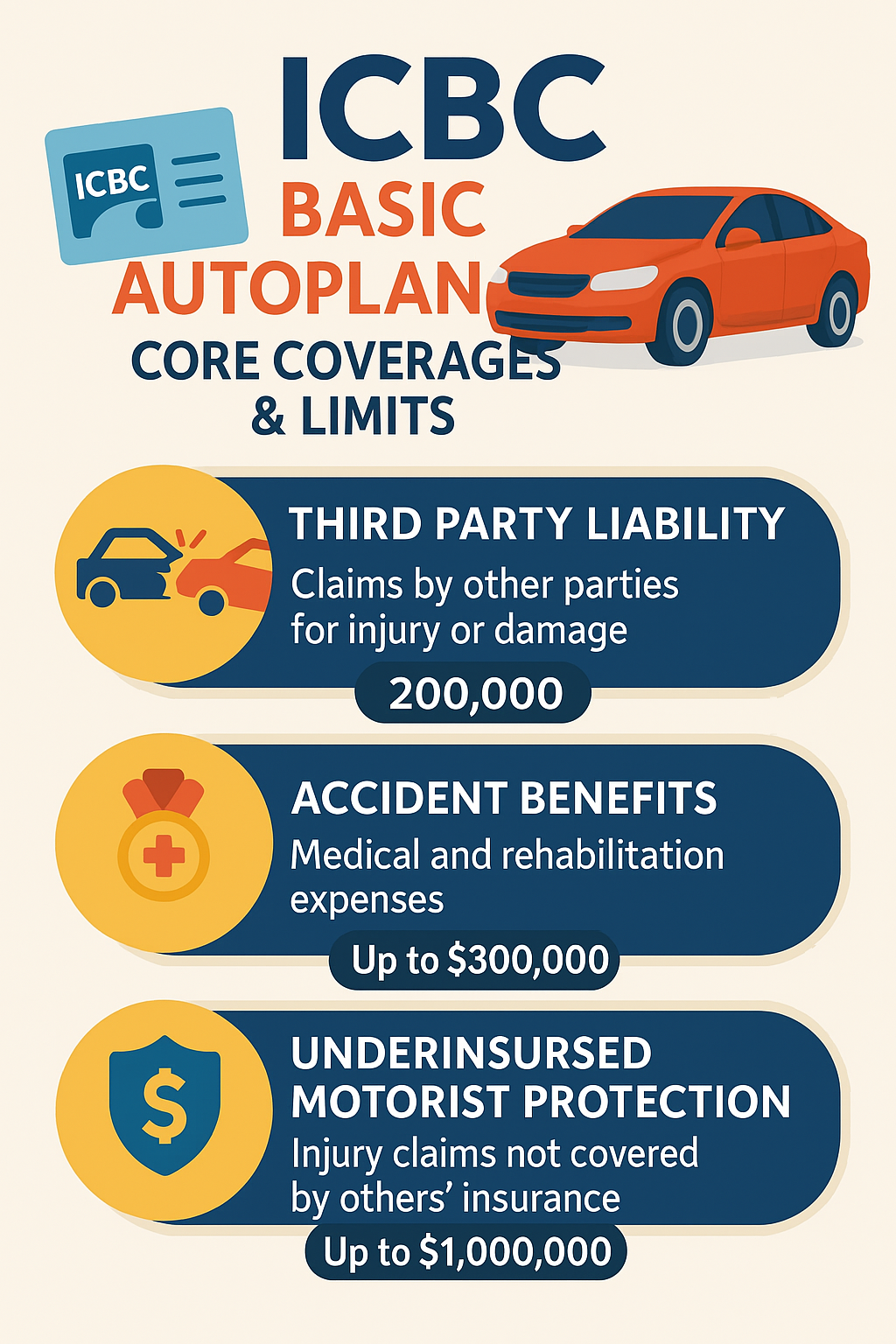

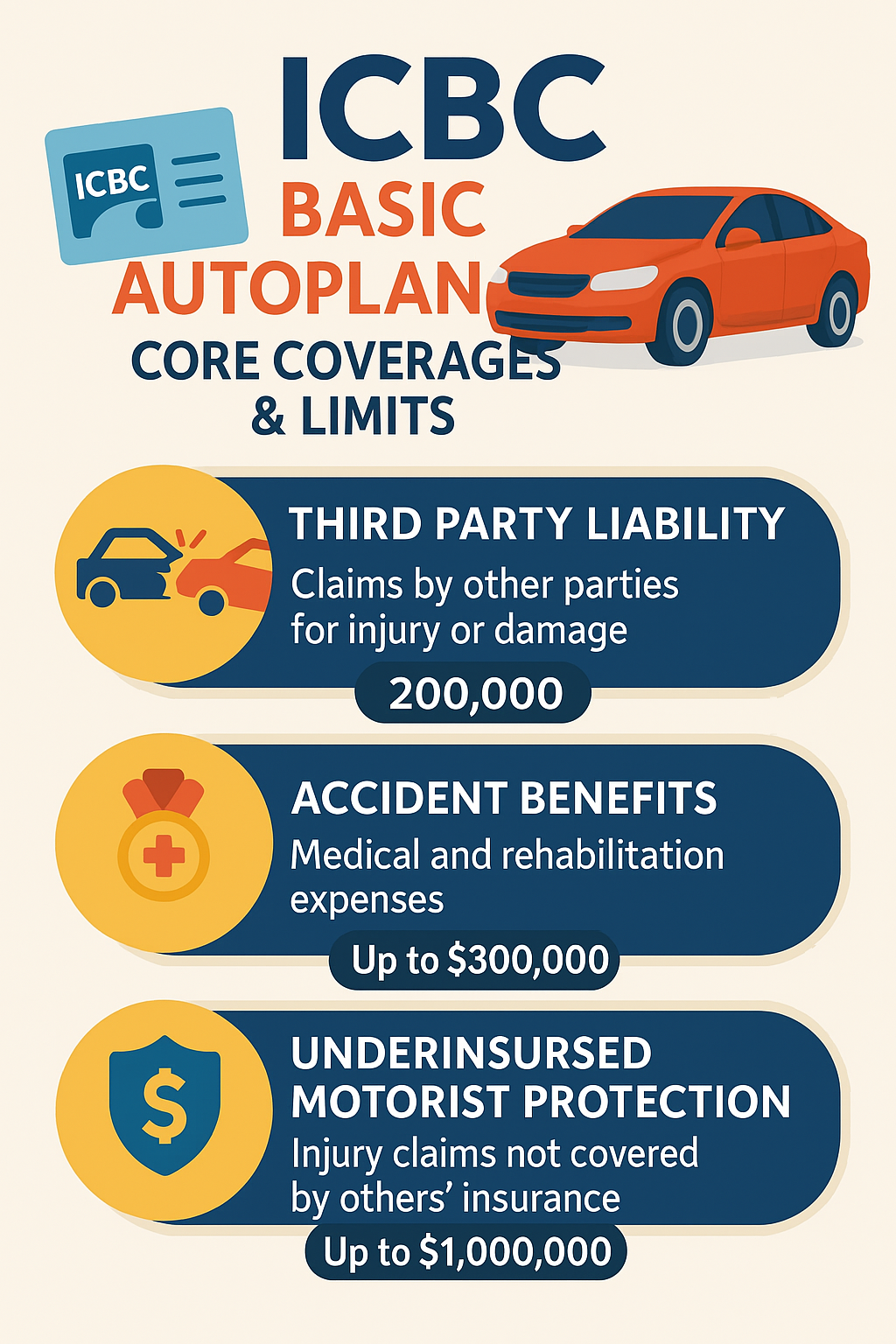

🚗 ICBC Basic Autoplan: Core Coverages & Limits 🇨🇦

If you drive in British Columbia, you know ICBC’s Basic Autoplan is mandatory. But do you know what it actually covers—and where it stops? Understanding

Get the most competitive quote from us. We have helped save 1000s of dollars for our clients.

Business liability insurance protects BC companies from financial losses due to lawsuits, covering legal costs and damages for third-party injuries or property damage.

Jump To Section:

What Is Business Liability Insurance?

Business liability insurance in British Columbia safeguards companies against financial losses resulting from lawsuits. It covers legal expenses and damages if a business is held responsible for third-party bodily injury, property damage, or financial loss. This insurance provides crucial protection for businesses of all sizes.

Business liability insurance in BC typically covers claims of third-party bodily injury, property damage, and advertising injury. It pays for legal defense costs, settlements, and judgments if your business is found liable. Coverage may also extend to product liability, completed operations, and personal injury claims such as libel or slander.

The amount of business liability insurance needed depends on your company’s size, industry, and risk exposure. Most small businesses in BC start with $2 million in coverage, but high-risk industries may require more. Consider your assets, revenue, and potential lawsuit costs when determining coverage limits. Consult an insurance broker for personalized recommendations.

While not legally mandated, business liability insurance is essential for most BC companies. It protects your business assets and personal finances from potentially devastating lawsuits. Many clients and landlords require proof of liability insurance before doing business with you. Even home-based businesses need coverage, as homeowners insurance typically doesn’t cover business-related claims. Without liability insurance, you risk paying out-of-pocket for legal fees and damages, which could bankrupt your business. Consider it a necessary investment in your company’s long-term security and stability.

Commonly Asked Questions

All types of businesses, from small startups to large corporations, should consider liability insurance. Industries such as retail, construction, hospitality, and professional services are particularly vulnerable to claims and can greatly benefit from this coverage.

Premiums are determined based on factors such as the type of business, industry risk level, annual revenue, number of employees, and claims history. Higher-risk businesses may face higher premiums.

General liability insurance covers bodily injury and property damage claims, while professional liability insurance (also known as errors and omissions insurance) protects against claims related to professional services or advice that result in financial loss for clients.

Yes, common exclusions may include intentional acts, contractual liabilities, employee injuries (which are typically covered by workers’ compensation), and damages resulting from pollution. Always review your policy for specific exclusions.

Yes, you can typically increase your coverage limits at any time by contacting your insurance provider. It’s advisable to review your coverage regularly to ensure it meets your current business needs.

This insurance covers legal fees, settlements, and judgments arising from third-party claims against your business. By covering these costs, it helps protect your assets from being depleted due to lawsuits or claims.

While not legally mandated for all businesses, certain industries may have specific regulations requiring liability insurance. Additionally, having this coverage is often essential for securing contracts or leases.

When selecting a provider, consider factors such as their reputation, customer service quality, coverage options, premium rates, and claims handling process. Reading reviews and seeking recommendations can also help you make an informed decision.

Discover our streamlined insurance process designed to be quick and straightforward. From initial quote to policy purchase, we guide you through every step to ensure your complete satisfaction.

Begin with your information to get a detailed insurance quote.

We’ll gather your personal or business information through our secure form to create an insurance quote just for you.

Review coverage choices from different providers and choose the best one.

We’ll guide you through comparing insurance options, helping you select the plan that best matches your coverage needs and budget.

We’ll help you secure your policy quickly, providing immediate access to your documents and full dedicated support.

Our team of experts specializes in home, auto, business, life, travel insurance, and more, providing you with tailored guidance to ensure you receive the best possible coverage.

Insurance Solutions for Every Need

Safeguard your life’s biggest investments with tailored home, auto, and commercial insurance solutions. Trust our expertise to provide personalized coverage that effectively protects your unique assets.

Comprehensive insurance protecting goods in transit and storage, ensuring your cargo and stock are covered against loss, damage, or theft worldwide.

Comprehensive insurance for marine transportation and logistics, protecting businesses against liabilities from cargo, vessels, and third-party claims.

Comprehensive protection for ports and terminals against property damage, liability, and operational risks in the global marine industry.

Protects shipowners from financial losses due to vessel detention following drug seizures by authorities.

Comprehensive marine liability insurance protecting shipowners, operators, and charterers against third-party risks, crew claims, and environmental liabilities.

Protects marine businesses against financial losses from third-party claims, ensuring security and stability in the global maritime industry.

Marine liability insurance protects businesses against legal liabilities from marine operations, covering third-party claims for injury, property damage, and pollution.

Marine War Risks Insurance protects vessels and cargo from war-related dangers, including piracy, terrorism, and civil unrest, ensuring financial security at sea.

Comprehensive protection for vessels and machinery, covering physical damage, collision liability, and a range of marine perils for global shipping companies

Rental property insurance in BC protects landlords from financial losses due to property damage, liability claims, and loss of rental income.

Tenant insurance in British Columbia protects your personal belongings and provides liability coverage, ensuring peace of mind while renting your home.

Protect your home and belongings with comprehensive Home Insurance in British Columbia, ensuring financial security against unexpected damages and liabilities.

Protect your condo in British Columbia with comprehensive insurance that covers personal belongings, liability, and additional living expenses, ensuring peace of mind.

Travel insurance in British Columbia protects you from unexpected medical expenses, trip cancellations, and lost belongings, ensuring peace of mind while traveling.

Umbrella insurance in British Columbia offers essential extra liability coverage, protecting your assets against unforeseen legal claims and financial risks.

Protect your investment with comprehensive Marine & Boat Insurance in British Columbia, ensuring coverage for damages, liability, and peace of mind on the water.

Protect your RV with comprehensive insurance in British Columbia, ensuring peace of mind while you explore the great outdoors.

Inland Motorcycle Insurance in British Columbia offers tailored coverage for motorcycle enthusiasts, ensuring peace of mind on the road and during off-seasons.

Fleet Insurance covers multiple business vehicles under one policy, protecting against liabilities like accidents, theft, and damage.

Commercial auto insurance covers vehicles used for business purposes, protecting against liability, damages, and accidents involving your company’s cars, trucks, or vans.

Auto insurance in BC covers your vehicle and protects against risks like accidents, theft, and third-party liability, ensuring safe and compliant driving.

S&S stands apart with a blend of local expertise and personal commitment, creating insurance solutions that resonate with your needs in British Columbia. We deliver personalized service that fits into your busy life.

Expertly crafted insurance solutions uniquely tailored to meet your specific lifestyle and coverage needs effectively.

Leverage our local knowledge to secure insurance that's suited for British Columbia’s unique market conditions.

Explore a wide range of personal and commercial insurance products, all through one comprehensive policy.

Committed to outstanding customer service, we ensure continuous support, making your experience stress-free.

Experience savings on your premiums with our competitive pricing without sacrificing the quality of your coverage.

Our team of professionals brings 30+ years of expertise to guide you through the insurance selection process.

In partnership with top insurers, we provide robust, reliable coverage tailored to meet your unique needs.

Open daily, with extended hours across multiple locations for easy access to our insurance services at your convenience.

Getting You The Best Quote

We work with trusted insurance companies to compare the best coverage and rates. Our team helps you save by offering tailored solutions that can beat your current policy and provide great value for your needs.

Trusted by Our Clients

See what our clients say about S&S Insurance—personalized service, expert advice, and unbeatable savings. Real experiences from satisfied customers who trust us to protect their home, business, and assets.

Stay informed with expert advice on insurance trends, coverage tips, and ways to save money. Our blog features articles that help you make smarter decisions about protecting your home, car, business, and more.

If you drive in British Columbia, you know ICBC’s Basic Autoplan is mandatory. But do you know what it actually covers—and where it stops? Understanding

Learn about EV insurance in Surrey. Discover coverage options, costs, and incentives to protect your electric vehicle investment.

Discover the benefits of tenant insurance for Surrey renters. Affordable and essential for secure renting.

Discover must-know travel insurance tips for Surrey residents. Stay protected on your trips with the right coverage and expert advice.

Protect your Surrey, BC home with flood insurance. Learn about costs, risks, and coverage to safeguard against unexpected flood damage.

Learn about what impacts home insurance premiums in Surrey, and learn strategies to reduce costs and maximize savings.